New information coming out on Friday, employment in a week and a half. For now:

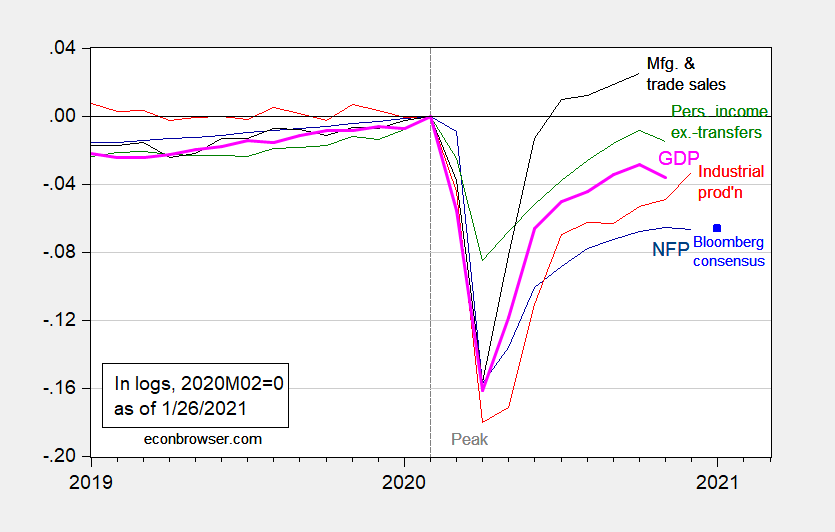

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus for January as of 1/26 (blue square), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (1/4/2021 release), NBER, and author’s calculations.

That’s brutal looking. We are a year past the crash and we are nowhere near close to closing the gap. Maybe by June? Maybe in another year? I’m more optimistic than I have been for a while, but this sure tempers it.

While brutal looking, those who are long in GameStop seem to be making a huge killing by nailing the short sellers to the wall. I haven’t seen something like this in a long time.

yeah, i have been following this the last couple of days. it is truly astounding and game changing. although it will not end like the fairy tale all those reddit retail investors believe in. this was a very unique situation, 140% of float was short, and much of it comes due this friday. the combination of such a naked short and short time frame does not happen very often. i have no sympathy whatsoever for those hedge funds who held naked shorts. that is not legal, and was a big problem during the very volatile days in the financial crisis. on the other hand, at some point the short squeeze will end. exactly who then will be left holding the bag of overvalued stock when it falls? a lot of day traders is my guess. then again, tesla never did fall.

but it will serve as a warning to many titans of finance who think they can bully the small guys. that reddit feed had 2.9 million followers. now perhaps not all are trading. but for sake of argument, if each trader plays with $1000 in this “game”, that site can use the power of social media to instantly throw $3 billion dollars of capital at any investment that the group gets worked up over. now if you have 1 investor throwing around $3 billion dollars, they must be quite careful. but 3 million individuals only risking $1k each allows them to take on much, much riskier positions than the big hedge funds. and when they know the rules of the game, like hedges forced to cover after certain amount of loss, they can game this system just like the big boys. they find a single target and feast. very fascinating to watch it play out. i have not had the courage to get into this particular game, though.

it appears today the retail brokers locked the market and only let GameStop holders close out their positions, and no buying was permitted. this was very, very bad. seems there are some reports that brokers like robinhood created the lockdown AFTER citadel purchased their own shorts today, allowing them to feast on the retail market as the price collapsed with no buyers permitted. it is all a messy situation. but if even only a quarter of the rumors are true around what transpired today, people should be jailed. any broker or hedge involved in this shutdown should lose the ability to participate in the markets. and it looks like both democrats and republicans are on board with an investigation. this may move from a financial bloodbath yesterday, to a criminal crusade today. interesting times we are living in. wall street should be legitimately concerned right now. the mob seems to be storming the castle.

https://www.scientificamerican.com/article/farm-protests-in-india-are-writing-the-green-revolutions-obituary/

January 24, 2021

Farm Protests in India Are Writing the Green Revolution’s Obituary

The country’s agricultural transformation of the mid-20th century left a legacy of inequity

By Aniket Aga

In September 2020, India’s Narendra Modi government circumvented parliamentary procedures to push through three bills that eased restrictions on private players in agricultural markets. The move enraged farmers—especially in the northwestern state of Punjab, an epicenter of the Green Revolution since the 1950s. After protesting in vain for two months, tens of thousands of Punjab farmers began a march to New Delhi in late November. The Modi government responded by deploying paramilitary troops armed with water cannons and tear gas shells, and protected by barricades, concertina wires and deep trenches dug into freeways at the borders of the capital city.

The demonstrations have since spread across the country and represent the largest-ever mobilization of farmers in independent India. They have already claimed over 70 lives; many have died of the cold and some have committed suicide as a political statement. The standoff is not just about the repeal of the three laws, but also includes the demand that the state guarantee minimum support prices (MSPs) for all public and private purchases of produce. In a broader perspective, however, this agitation is writing the obituary of the Green Revolution.

The Green Revolution—essentially the promotion of capital-intensive industrial agriculture—was more of a Cold War stratagem than a humanitarian initiative, as recent histories have forcefully argued. After independence in 1947, peasant movements led by communists had mounted fierce pressure on the Indian National Congress, the ruling political party, to redistribute land from landlords to peasants.

But the Congress, beholden to landlords for electoral support in rural areas, was unwilling to implement comprehensive land reforms. In this context, the U.S. government promoted the Green Revolution to preempt a Soviet-style “Red Revolution,” as U.S. Agency for International Development administrator William Gaud stated in a speech in 1968. It comprised subsidized fertilizers and irrigation, rice and wheat varieties bred to absorb high fertilizer doses, and state-led training programs to assist farmers in transitioning to new practices. Given the expense, it was rolled out only in a few, well-endowed districts of Punjab and a few other states. Because bumper productions inevitably depress prices, farmers were guaranteed procurement through state-run mandis or market yards at MSPs declared in advance. State procurement was therefore crucial to transforming Punjab into India’s breadbasket.

In sum, the Indian government held out the promise of provisioning the hungry with subsidized cereals and pumped massive investments to win over the well-off segments of landowning farmers. Alternative ideas for science-backed agricultural development, such as relying on locally available varieties and agroecological adaptations, were never seriously considered.

But as many argued, the Green Revolution package created more problems than it solved. By the 1980s, even the geographically limited package proved fiscally onerous. As state support declined, the problem of unremunerative prices and debt escalated. So did ecological crises such as falling groundwater tables, saline and degraded soils, biodiversity loss and health disorders from pesticide use—culminating in a full-blown agrarian crisis by the 1990s and an epidemic of suicides by farmers.

Modi hails the laws as watershed reforms that will usher in a new era of prosperity for farmers backed by corporate investments. On the face of it, they allow private buyers to purchase farm produce outside of the supervision of and without the payment of taxes and fees to mandis; limit state intervention in retail prices; and provide a framework for farming on contract to corporations.

In their details, however, the farm laws intrude upon the regulatory powers of state governments and intensify the already severe power asymmetry between corporate houses and the mass of Indian farmers…

Masha Gessen~~~Lesbian Russian Jew~~~ the absolute sharpest mind and best lady to understand both what is happening in Russia right now, and Russia’s relationship with America.

https://www.pbs.org/newshour/show/russian-opposition-leaders-arrest-sparks-wave-of-national-protests

Masha is really a great lady, and another example of MANY of why immigrants benefit America.

Why do I have to know that she is a jew and a lesbian?

January 26, 2021

Coronavirus

US

Cases ( 26,011,222)

Deaths ( 435,452)

India

Cases ( 10,689,268)

Deaths ( 153,724)

UK

Cases ( 3,689,746)

Deaths ( 100,162)

France

Cases ( 3,079,943)

Deaths ( 74,106)

Germany

Cases ( 2,163,113)

Deaths ( 54,390)

Mexico

Cases ( 1,771,740)

Deaths ( 150,273)

Canada

Cases ( 757,022)

Deaths ( 19,403)

China

Cases ( 89,197)

Deaths ( 4,636)

January 26, 2021

Coronavirus (Deaths per million)

UK ( 1,471)

US ( 1,311)

Mexico ( 1,159)

France ( 1,134)

Germany ( 648)

Canada ( 512)

India ( 111)

China ( 3)

Notice the ratios of deaths to coronavirus cases are 8.5%, 2.7% and 2.4% for Mexico, the United Kingdom and France respectively.

https://news.cgtn.com/news/2021-01-27/Chinese-mainland-reports-75-new-COVID-19-cases-XnSvK0QSME/index.html

January 27, 2021

Chinese mainland reports 75 new COVID-19 cases

The Chinese mainland on Tuesday recorded 75 new COVID-19 cases – 55 local transmissions and 20 from overseas – the National Health Commission said on Wednesday.

Of the locally transmitted cases, 29 were reported in Heilongjiang Province, 14 in Jilin Province, 7 in Hebei Province, 4 in Beijing and 1 in Shanghai, the Commission said.

No new death related to COVID-19 was registered on Tuesday, and 98 patients were discharged from hospitals.

A total of 61 new asymptomatic COVID-19 cases were recorded, while 991 asymptomatic patients remain under medical observation.

The total number of the confirmed COVID-19 cases on the Chinese mainland has reached 89,272, and the death toll stands at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-01-27/Chinese-mainland-reports-75-new-COVID-19-cases-XnSvK0QSME/img/078dae0d06364e0f9a102f8eb9a0f1f3/078dae0d06364e0f9a102f8eb9a0f1f3.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-01-27/Chinese-mainland-reports-75-new-COVID-19-cases-XnSvK0QSME/img/415cba6b3d7b440ebe7920dfc824c02e/415cba6b3d7b440ebe7920dfc824c02e.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-01-27/Chinese-mainland-reports-75-new-COVID-19-cases-XnSvK0QSME/img/a3fe37c9103648459a8aabcfe76292b0/a3fe37c9103648459a8aabcfe76292b0.jpeg

Latin American countries have recorded 4 of the 13 highest and 6 of the 24 highest number of coronavirus cases among all countries. Brazil, Colombia, Argentina, Mexico, Peru and Chile.

Mexico, with more than 1.7 million cases recorded, has the 4th highest number of cases among Latin American countries and the 13th highest number of cases among all countries. Peru, with more than 1 million cases, has the 5th highest number of cases among Latin American countries and the 18th highest number among all countries.

Mexico was the 4th among all countries to have recorded more than 100,000 and now more than 150,000 coronavirus deaths.

January 26, 2021

Coronavirus (Deaths per million)

US ( 1,311) *

Brazil ( 1,026)

Colombia ( 1,018)

Argentina ( 1,040)

Mexico ( 1,159)

Peru ( 1,207)

Chile ( 938)

Ecuador ( 824)

Bolivia ( 854)

Panama ( 1,180)

Costa Rica ( 501)

* Descending number of cases

https://cepr.net/thomas-friedman-the-donald-trump-of-the-new-york-times/

January 27, 2021

Thomas Friedman: The Donald Trump of the New York Times

By Dean Baker

Donald Trump is a person who glories in his own ignorance. He seems to know little about anything and clearly doesn’t care. Any evidence that contradicts his pronouncements is simply “FAKE NEWS.”

Thomas Friedman seems to have the same attitude as he makes grand pronouncements about the economy that are transparently absurd. I discovered this in his latest column, * which carried the promising headline, “Made in the U.S.A.: Socialism for the Rich. Capitalism for the Rest.”

It turns out that the gist of Friedman’s “socialism for the rich” is low interest rates. Following Ruchir Sharma, chief global strategist at Morgan Stanley Investment Management, Friedman is upset that we don’t have recessions and have more businesses fail. I am not kidding, he literally says this:

“Meanwhile, he added, as governments keep stepping in to eliminate recessions, downturns no longer play their role of purging the economy of inefficient companies, and recoveries have grown weaker and weaker, with lower productivity growth.”

This statement is bizarre for two reasons….

* https://www.nytimes.com/2021/01/26/opinion/us-capitalism-socialism.html

The two indices that are goods oriented (industrial production and mfg & trade sales) look reasonably good even though GDP, employment and income look weak. Not that we needed any more evidence to support the obvious, but the problem is in the services sector. That should inform any economic rescue and/or stimulus plan.

“That should inform any economic rescue and/or stimulus plan.”

what i seem to be hearing out of the biden white house, is they are not against this. and i agree. i got a stimulus check last time, or at least part of one. it was not necessary, but i am not one to put money back into trumps hands. however, targeting people who are actually falling behind would be more efficient and effective. stimulus should address missed paychecks and not missed pay raises.

Not to worry, Gov. Newsom and Gov. Whitmer have declared the COVID-19 emergencies as past tense and are moving forward to a new green economy with old Uncle Joe.

https://www.liuna.org/news/story/canceling-keystone-kills-union-jobs

“Gov. Newsom and Gov. Whitmer have declared the COVID-19 emergencies as past tense”

Who is paying you for these disgusting lies now that Kelly Anne Conway is on the government dole. I see you just skipped all the rebuttals of your past really stupid comment on the Keystone Pipeline preferring to dust off some dumbass letter from a special interest labor union that no one has ever heard of.

What’s the matter Brucie – did Parler kick you off for being the Stupidest Man Alive?

“the Laborers’ International Union of North America – are on the forefront of the construction industry”

Like there are no other construction projects out there? Come to NY as we need a new airport, a new tunnel under the Hudson River and tons of other construction projects. Yes this is about the dumbest argument ever – not enough construction project opportunities. BTW the one strong sector noted in the latest BEA release on GDP growth 2020Q4 was investment.

Bruce “no relationship to Robert” Hall. Stupidest Man Alive Alive.

Wow – Bruce Hall has a job – writing copy for the Oregon Republican Party:

https://econospeak.blogspot.com/2021/01/the-oregon-republican-party-issues.html

Bruce sounds like those hedge funds getting crushed with gamestop. “Those guys aren’t playing fair. Wahhhwahhwahhh!”

January 26, 2021

Coronavirus

Israel

Cases ( 613,578)

Deaths ( 4,512)

Deaths per million ( 491)

———————————–

July 4, 2020

Coronavirus

Israel

Cases ( 29,170)

Deaths ( 330)

Deaths per million ( 36)

[ Having apparently approached a containment of the coronavirus in June, the Israeli government incautiously opened schools and businesses, and the result has been a persistent community infection spread contributing to what are now 621,590 cases in the small country as compared to 89,272 in all through all of mainland China. Israel unfortunately now has just about 7 times the number of coronavirus cases in mainland China. Paul Krugman noticed the Israeli “disaster” on September 14 when there were 160,000 coronavirus cases. ]

January 26, 2021

Coronavirus

Massachusetts

Cases ( 506,183)

Deaths ( 14,220)

Deaths per million ( 2,063)

New York

Cases ( 1,394,675)

Deaths ( 42,815)

Deaths per million ( 2,201)

[ The New York Times tells me today, my seemingly fortunate neighborhood is “extremely high risk.” The point however should be to explain why, which is not done, but there we have a reflection of the remarkable public health failing that we have experienced. ]

ltr

I know how to find that data.

I just scroll past your name.

Tell me something new or interesting. Please.

I’ve been scrolling past her repetitive wastes of time for months. She should be a decent person and just got this out.

Dilbert, amen to all three sentences.

Willie wrote: January 26, 2021 at 12:48 pm

That’s brutal looking. We are a year past the crash and we are nowhere near close to closing the gap. Maybe by June? Maybe in another year? I’m more optimistic than I have been for a while, but this sure tempers it.

————————————–

Interesting. My reaction is the opposite. I am impressed/slightly surprised that real economies in rich countries are doing as well as they are doing.

Economies would be doing better if people could do this ‘social cooperation’ thing better.

From my perspective, the vaccine optimism is way over done in terms of near-term outcomes.

In passing, for folks looking for a single, coincident indicator of where the ‘economy’ is going, look no further than benchmark oil prices.

Looking at some charts on Bill McBride’s blog today confused me a little. It looks like we are officially not still in a recession. Are we in one now, are we seeing a double dip, or is the original one still going? If we ever were officially out of recession, I missed it.

Willie According to NBER: “… a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months. In our modern interpretation of this definition, we treat the three criteria—depth, diffusion, and duration—as at least somewhat interchangeable. That is, while each criterion needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another. For example, in the case of the February 2020 peak in economic activity, the committee concluded that the subsequent drop in activity had been so great and so widely diffused throughout the economy that, even if it proved to be quite brief, the downturn should be classified as a recession.”

NBER declared the beginning of the recession. It hasn’t declared a trough (i.e., and end to the recession), because (1) the data will be revised, and (2) the trajectory might be such that we continue downward.

Thank you. And I see there is a new post about this to read next.

Advanced 2020QIV estimate of real GDP growth ANNUALIZED = 4% (which means it rose by a mere 1%). That reduced the yuuuge output gap we have right now by only a very wee amount. Hope this clears up your confusion.

Hitting bottom is different from still being ina hole. I assume we are still in a hole. The definition and timing of the beginning and end of recessions is usually signaled by talking heads saying we are not in a recession. That means we are. And then saying there is no hope, or words to that effect. That means we have hit bottom and are climbing out. Neither of those magic 8 ball techniques has worked this time, probably because there has been so much political and pandemic static that overwhelmed the usual signals.