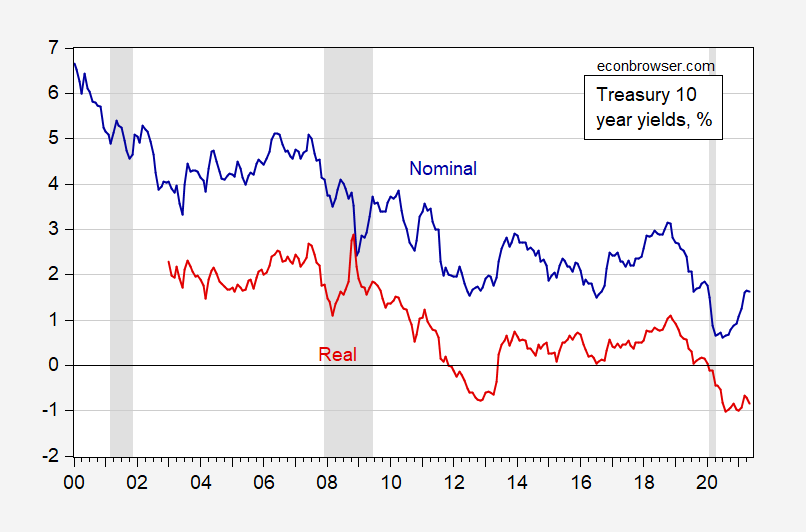

As of May 2021, the nominal 10 year Treasury rate is 1.6%. The real rate is -0.9%.

Figure 1: Nominal 10 year Treasury yield (blue), 10 year TIPS (red), both in %. NBER recession dates shaded gray; latest recession assumed to end 2020M04. Source: Federal Reserve via FRED, Treasury, and NBER.

It’s noteworthy that — despite the runup in real and particularly nominal rates — May 2021 real rates are still below anything experienced in the the recovery from the Great Recession, and only slightly higher than the all time lows recorded in August 2020 and January 2021 (monthly averages of daily data).

Hence, this seems an ideal time for the Federal government to lock in interest rates.

Us savings bonds, i series, are now yielding 3.5%. For those needing to store $10k to $20k, not a bad option for the upcoming year. You can make up for years of low bank rates in just one year. If inflation becomes more than transitory, this will be a nice multiyear risk free investment.

Not sure why you qualified your statement with ” I inflation becomes more than transitory”. If inflation is transitory, this would be an OK yield. The more inflation (more than transitory), the less OK the yield, yes?

Similarly, I’m not clear on why Menzie seems to imply that a current low real rate is he important fact in deciding when to lock in rates. Real is nominal minus expected inflation, but we know inflation expectations are iffy as forecasts. The prudent guide, I would think, is the nominal rate because of the uncertainty of future inflation. Taxes are in nominal terms. Most government coupon payments are nominal. If inflation are running at 10% and bond yields at 9.1%, would he government be wise to lock in?

Yields remain quite low in nominal terms, as well, so this is a good time to lock in on that basis, though any earlier time since the onset of he recession would have been better.

“If inflation are running at 10% and bond yields at 9.1%, would he government be wise to lock in?”

The long-run solvency of our fiscal financing depends on real interest costs not nominal. Yes government spending and taxes are expressed in dollar terms but what matters is real income.

You’ve made a claim but offered no support. No reason for anyone to be convinced.

I’m aware of the whole nominal vs real bit. I don’t see the case here. One compares nominal to nominal, etc. Withi revenue and expenditure both nominal, there is no need to adjust for inflation, much less often inaccurate expectations of future inflation.

The only real problem is that, with a large structural deficit, high inflation leads ro higher deficits.

Menzie’s claim that now is a good time to lock in could be based simply on low rates, real and nominal. That’s fine. If he meant that low real rates, without regard to nominal rates, I don’t see why. You didn’t contribution anything to an answer.

Macroduck: I meant low *real* rates, which are the relevant variable for the fiscal burden of the government.

I series bonds are linked to cpi-savings bonds. That is why they just increased yield-almost doubled. It resets twice a year. So if inflation (and fed rates) increase, the i series yield will increase. If inflation is transitory and drops, the i series yield will also drop. They act almost like tips, but are not permitted a negative yield. They are also variable rather than constant rate. Unfortunately an individual can only invest $10k per year. But a couple can sock away some savings and make a little more yield right now.

I bonds are not currently a great deal. The fixed rate is zero. Sure, it protects you against inflation, but that’s it. If inflation goes to zero, you get nada.

Back in 2000 I bought I bonds. Since then their value has more than tripled, half of the increase inflation, half real. That’s about the same as the S&P 500 with dividends reinvested over the same period. Plus, the value of I-bonds never decreases.

Unfortunately the Treasury decided to tie the fixed rate on I-bonds to short term rates (I-bonds have a 30 year term), and I-bonds have since become an abysmal long term investment.

Let me get this straight. These bonds have a zero real rate as he explained, which I admit is not going to turn the bond holder into Bill Gates tomorrow. But did you not notice that Menzie’s posts shows the real return on 10-year government bonds is NEGATIVE 0.9%?

Or maybe your advanced fuzzy arithmetic has negative 0.9% being great than zero.

I’m sorry but this is carnival barker level of utter stupidity.

He’s making it up on volume.

The interest rates the government can borrow at makes the infrastructure upgrades that are being debated a complete non-brainer. I hope the dithering doesn’t mean we miss the opportunity, because we will pay more later for less return.

The only thing that is guaranteed on that I-bond is 1.77% for the next six months. The fixed rate is set at zero for 30 years. The inflation adjustment could be set at zero for the second six months. The max you can invest is $10K per year. And you lose 3 months interest if you withdraw before 5 years.

So you might make $177 or even $354 this year, if inflation stays at the rate of the past six months. Wow!!!

Talk about not addressing the point. Maybe the simple point eludes you as usual.

a couple can put $20k total in the bond. so that is probably $700 in one year. and if you believe inflation is here, that will be repeated next year. and since this is money that was probably sitting in a bank account earning 0.01%, it is an improvement. especially since it takes about 5 minutes of work to set up a treasury account. consider this as $700 stimulus from the federal government. not sure why somebody would ridicule a $700 stimulus, unless you are a republican who does not want the average joe to get a handout from the government. show me another place you can get a 3.5% return risk free on $20k? i am not poor, but i certainly am happy to make an additional $1000 this year (i will create an account for my child as well).

while it is great if you can hit financial home runs, wealth is created over the long haul by taking the small steps that accumulate total wealth.

my comments on the savings bonds were not meant to be controversial, simply informative. it is an easy way for a number of people to pocket some extra change. it really is money for nothing in this case.

chase bank has a current savings rate of 0.01%. the current i series bond has a rate of 3.54%. these are nominal rates. it probably won’t change much for at least a year. possibly more. and the rate in the savings bond is risk free. and it is true that there are limits to how much one can place in this investment. but there is nothing making you hold these for 30 years, if conditions change. and since the fed seems to be committing to higher rather than lower inflation, not sure why you wouldn’t move money from a savings account into the savings bonds. my wife and i just moved $20k of save money into the savings bond. it had made zero money the last few years. now it will make possibly $700 over the next year. it took about 5 minutes to set up the treasury account to hold the ibonds. yes it won’t make us rich. but that is some pretty easy money to be made for doing next to nothing. it seems like not much per year, but it adds up over time. banks have done a really good job convincing people that they should not earn any interest in their checking and savings accounts since the financial crisis. that is one reason why banks have become so profitable.

Even the 30-year TIPS rate is slightly negative. Now if the government does this 10-year TIPS deal, it gets a negative 0.9% rate.

But suppose it locks in with that 1.6% nominal rate. Of course we do not know what actual inflation will be over the next 10 years. Maybe it averages 2.5% per year. But if our resident INFLATIONISTA aka Little Chicken are right, then the actual cost could be less than 1% per year. Go for it!

https://cepr.net/the-booming-economy-and-debt-and-deficit-fears/

May 30, 2021

The Booming Economy and Debt and Deficit Fears

By Dean Baker

Most of the data on the economy is looking very good these days. The number of weekly unemployment claims has fallen sharply. Levels are still high, but just over half the level we were seeing earlier this year. And, this is before all the moves by Republican governors to cut back benefits, so the decline reflects the availability of jobs, not more stringent eligibility.

Consumer spending has been rising rapidly, with the March and April levels both above where they were before the pandemic. Even restaurant sales have largely recovered. Adjusted for inflation, the April levels were just 2.7 percent below where they were in February, 2020.

The housing market continues to be very strong, especially in lower priced areas. The increase in the Federal Housing Finance Administration’s house price index from the first quarter of 2020 to the first quarter of 2021 was 16.0 percent in Wichita, KS, 15.8 percent in Buffalo, NY, 15.6 percent in Dayton, OH, 14.6 percent in Nashville, TN, and 13.8 percent in Gary, IN. By contrast, prices are up just 9.7 percent in the New York metro area and 6.5 percent in San Francisco.

It is too early to know if this is the start of a trend, where people take advantage of increased opportunities for remote work to live at lower cost, or whether it is a one-time blip. However, if the opportunities for increased remote work stay in place after the pandemic is over, it is likely that more people will move to low-cost areas. This will both benefit those areas, by bringing in new consumers and taxpayers, and also the high cost areas, by relieving pressure on house prices.

Residential construction has also been very strong, running at close to 25 percent above the pre-pandemic pace. Starts did slow some in April, which is likely due to a shortage of materials, most importantly lumber. This should be alleviated in the months ahead.

Investment also is strong. New orders for capital goods are running more than 10 percent above the pre-pandemic level. This is noteworthy because it doesn’t appear that the prospect of higher corporate income taxes is doing much to discourage new investment.

With the rapid growth we are now seeing across most sectors in the economy, many have raised concerns about inflation. We did see high inflation numbers in April. There are two main factors here. First, much of this is a bounce back effect, where the price of many items that plunged during the recession is now rebounding back to more normal levels. This is true in areas like hotels, airfares, and car insurance.

The other factor is that there are shortages in many areas as the economy is again getting up to steam. This is the case with lumber, where many mills shut down, anticipating a longer recession. It will take some time to get them up and running again. It is also the case with cars, where a shortage of semi-conductors, due to a fire at a plant in Japan, has hampered production. New car prices rose 0.5 percent in April, while used car prices rose an incredible 10.0 percent in the month, adding almost 0.3 percentage points to the CPI.

Both of these effects will be temporary. If we are to see sustained inflation then we really need a story where wage growth is substantially outpacing productivity growth. This is not the case at present. Wage growth has at best accelerated modestly, with the average hourly wage rising at an annual rate of 3.1 percent, comparing the last three months (February, March, April) with the prior three months (November, December, January).

This would not be the basis for real concerns with inflation, even if productivity had stayed on its pre-pandemic pace of just over 1.0 percent annually. However, productivity growth has accelerated sharply in the last year, rising 4.1 percent from the first quarter of 2020 to the first quarter of 2021. With GDP growth projected at close to 10 percent for the second quarter, we will almost certainly add another strong quarter of productivity growth.

It is not plausible that we will sustain productivity growth of 4.0 percent, but if the pace falls back to 2.0 percent, instead of its pre-pandemic 1.0 percent rate, it is hard to see inflation becoming a problem. A 2.0 percent rate of productivity growth is consistent with 4.0 percent wage growth and 2.0 percent inflation….

does it matter, your treasury pays nominal rates not real ones.

Not Trampis: Rate of debt/gdp increase (d-dot) depends on effective real rate (r) minus real GDP growth rate (g).

d-dot = (r-g)d – p

where p is primary surplus/gdp ratio.

Put differently – as long as the present value of future primary surplus (s/r – g) exceeds debt (where s = tax rate minus spending/GDP) then the debt/gdp ratio will eventually fall over time.

The literature on this sort of exploded during the high inflation late 1970’s and early 1980’s. People should read it.

Gentlemen,

most people know this but it was NOT the gist of my statement.

[ In my best Dale Gribble voice imitation ] ‘Merica!!!!!

This report was requested by an Econbrowser reader:

https://news.cgtn.com/news/2021-05-28/China-s-artificial-sun-sets-new-world-record-10DkBZ6ceha/index.html

May 29, 2021

China’s ‘artificial sun’ sets new world record

Chinese scientists set a new world record on Friday by achieving a plasma temperature of 120 million degrees Celsius for a period of 101 seconds, a key step toward the test running of a fusion reactor.

The breakthrough was announced by Gong Xianzu, a researcher at the Institute of Plasma Physics of the Chinese Academy of Sciences (ASIPP), who is in charge of the experiment conducted in Hefei, capital of east China’s Anhui Province.

The experiment at the experimental advanced superconducting tokamak (EAST), or the Chinese “artificial sun,” also realized a plasma temperature of 160 million degrees Celsius, lasting for 20 seconds.

The ultimate goal of EAST, located at ASIPP in Hefei, is to create nuclear fusion like the Sun, using deuterium abound in the sea to provide a steady stream of clean energy.

It is estimated that the deuterium in one liter of seawater can produce, through fusion reaction, the amount of energy equivalent to 300 liters of gasoline.

Around 300 scientists and engineers mobilized to support the operation of the doughnut-shaped experiment facility, which includes a vacuum system, RF wave system, laser scattering system, and microwave system. Preparation and upgrading work for the experiment started about a year ago, the institute said.

“It’s a huge achievement in China’s physics and engineering fields. The experiment’s success lays the foundation for China to build its own nuclear fusion energy station,” said Song Yuntao, director of ASIPP.

In November 2018, EAST generated an electron temperature of 100 million degrees Celsius in its core plasma, nearly seven times the temperature of the Sun’s interior. Last year, EAST achieved a plasma temperature of 100 million degrees Celsius lasting for 20 seconds….

Getting there, if not quite ready for a functioning commercial source. Princeton tokomak and the facility at Grenoble look to be behind on this.

“It is estimated that the deuterium in one liter of seawater can produce, through fusion reaction, the amount of energy equivalent to 300 liters of gasoline.”

That is correct. However, the more interesting question is whether the price of a kWh of electrcity generated by fusion is competitive. In the past projected costs were taken from NPPs which are economically dead as dead can be.

i am pulling for fusion to be a winner. but my money is on renewables for the next 20 years, at least.

“i am pulling for fusion to be a winner. but my money is on renewables for the next 20 years, at least.”

That is a nice oxymoron. 🙂

If we are talking about GHG reduction, only the next 30 years are really interesting, stable fusion with positive energy balance is not possible in a lab bench experiment, for a commercial reactor we would have to wait at least ten years more. Optimists are now talking about 2040. 🙂

We have no idea how much fusion will cost, wind power and PV show nice scale effects, therefore, we have a good idea for the maximum price in a few years. Fission and fusion may die for very simple econoimic reasons….

Fusion will produce radioactive waste (not as long-lived as in case of fission, but still an issue), this means an additional political price in comparison to PV and wind power.

“If we are talking about GHG reduction, only the next 30 years are really interesting,”

energy is a two part problem, even in the long term. supply and pollution. both fusion and renewables play a role in both. and if either of them provide a game changer, we win. hence i support them both, and will embrace whichever wins today and tomorrow. it is only a matter of time before we learn to harness fusion, of that i am confident. longer term, the possibility of fusion will continue to push renewables to be more efficient.

Well, while we are talking about alternative nuclear and GHGs, more immediately available are thorium fission reactors, being pursued in Indonesia and some other developing nations. invented in the US in the 50s in the US they got dropped because one cannot make bombs from them, which now looks like a positive. They are also much safer, less waste problems, and we have lots of thorium around, all in all, looking much better than uranium fission ones. And no GHGs, and much more commercially ready than fusion, which still may never get there. Thorium reactors could easily helpe well within the next 30 years, although not obvious to me why that is some big deal deadline.

“Us savings bonds, i series, are now yielding 3.5%. For those needing to store $10k to $20k, not a bad option for the upcoming year.”

The real yield for I-bonds is 0.00%. The inflation component is recalculated every 6 months based on the recent CPI. As we know, the recent inflation number is somewhat “inflated” coming from a recession low. That inflation component will be recalculated in October based on the more current 6 months CPI so that 3.5% composite yield is likely to come down.

0.00% real for I-bonds is better than -1.00% real for nominal treasuries or TIPs, but I-bond purchases are limited to $10,000 per year. So you are talking about an extra $100 a year. Better than a poke in the eye with a sharp stick but not exactly life changing.

Keep in mind that you lose 3 months interest if you cash in your I-bond in less than 5 years.

Double that for a couple. Its just a recommendation for cash sitting in a savings account or money market account with a zero yield. Agree not life changing. But if inflationistas are right, it is profitable over the next couple of years at zero risk. And if they are wrong, still better than a money market. People let this type of cash sit in banks for years. This will get them some return. In january a couple can deposit another $20k. So in 6 months, they can get a total of $40k possibly earning 3.5% . Not bad for a safe money account.

“0.00% real for I-bonds is better than -1.00% real for nominal treasuries or TIPs”

True but please do not tell JohnH that as he really hates it when someone contradicts his usual fuzzy arithmetic!

My favorite sentence from John “Grumpy Economist” Cuckrant’s latest:

“I have long thought that the US conquest of inflation had a fiscal and monetary part.”

Folks, this is indeed a “watershed moment” and turning point for macroeconomics. Only to be matched by Barkley Junior’s major achievement of figuring out SAAR is part of tabulating headline quarterly GDP. I haven’t been this excited since noticing that most household faucets have both a cold AND hot water handle. Is this exciting or WHAT!?!?!?!?!?!

Naomi Osaka decided to drop out of the French Open, after she was threatened by Tennis officials she would be excluded from participation for not talking at media events. So after she withdrew on her own, after the threat made by tennis officials, the President of the French Tennis Federation…… wait for it……. wait for it…….. wait for it…….. wait for it……. wait for it…….. refused to take questions at his own press conference today.

https://www.npr.org/2021/05/31/1001936516/naomi-osaka-quits-french-open

C-L-A-S-S-Y

I noticed the irony as well. We have these boards-think ncaa-that are disconnected from reality in a bad way. Its about control over another group of people.

She should do a Marshawn Lynch. Show up for the interview and repeat over and over “I’m only here so I don’t get fined”.

One former NFL player who gets it suggested athletes should in the future insist on interviews on Zoom.

Player Unions could get that one done easily, along with many other things to upset a worthless NCAA bureaucracy’s gravy train, but outside of maybe Northwestern University, no college football player labor Unions currently exist:

https://dailynorthwestern.com/sports/northwestern-nlrb-union-effort/

https://www.si.com/college/2015/07/14/ncaa-46-million-judgment-antitrust-lawsuit

https://theundefeated.com/features/fight-ed-obannon-started-with-ncaa-basketball-isnt-over-yet/

“Just the threat of a boycott would change the game. But the person or team that does it would carry that for life. A lot of people would not understand the boycott. They would ask ‘Why us? Why you? Why our team? Why this game?’

PLAYERS would have to do this en mass to make the NCAA truly take notice and grab the power players deserve. It would be easier than it would have been make in 1985, if players used their mobile phones, or perhaps a phone app made for the distinct function of organizing a player strike/boycott/Union. Or just a player Labor Union

This is the BIGGEST fear of all the NCAA bureaucracy right now. That one day Black athletes and their cohorts that make the NCAA literally BILLIONS of dollars every year, will ONE DAY grow a brain, form a college players Labor Union, and if Menzie will just once allow me the appropriate terminology here, not be crapped on en mass by the NCAA.

@ Baffling

I have a lot of pet peeves on that (NCAA), my personal “favorite” is college football players, some of them not even on scholarship, i.e. they are paying their own way through college, who are told they MUST sit out one year after a transfer.

https://www.cbssports.com/college-football/news/oklahoma-coach-lincoln-riley-defends-stance-in-delaying-transfer-qb-chandler-morris-being-released-to-tcu/

https://mountaineersports.com/inside-the-deeply-disturbed-mind-of-lincoln-riley/

Think of how this would go over if they were a finance major, or any other major, and when they transferred were told they could not get a job in their chosen field for a full year after transferring. It would not fly. But when they do it to black athletes, or low-income whites who happen to play football, because it is mostly blacks who this rule effects, all of the fans just shrug their shoulders and say “well, the university has that right”. The universities and head coaches claim this ‘right” to abuse athletes in this way, even when the players are NOT ON SCHOLARSHIP. Then they wonder why some blacks say that slavery still exists. It is those black athletes that fill up the football stadiums and sell the tickets, making high-skill plays in which they are at risk of becoming quadriplegics at ANY MOMENT

https://www.npr.org/2013/09/06/219692801/back-at-school-injured-player-fights-on-after-fateful-tackle

Notice that when an NCAA head football coach dumps his former team for a higher paying job, he keeps on working, with total freedom, often with a better salary. Not only that, often after committing recruiting violations that his former team’s players get punished for, while that same coach committing the violations walks off “scot-free” to his next job. Think of the current head coach of the Seattle Seahawks and the clusterF— he left at USC. Well, those coaches are mostly white guys, and not only that, they go to press conferences where they are worshipped by mostly functionally illiterate fans who never even attended the university of the football team they root for, and coaches keep their mouths shut about all the ways the NCAA uses the money for an 80% unnecessary bureaucracy in which they make 6-figure or 7-figure salaries and hand out jobs to their white crony friends. But as long as those head coaches of NCAA football keep their mouths shut about all the ways that TV money, ticket money, and merch money that the black athletes make for them is spent and doled out—no worries—those head coaches will NEVER be punished or asked to sit out a year for jumping schools or even really for recruiting violations. It is always their players who will take that hit. Because….. well because hypocritical bastards like Lincoln Riley and the NCAA apparatus say “Because……. ” ~~~that is “why”.

the rich paul rule clearly outlined the elitist and racist decision making that has controlled the ncaa for a while now

https://www.si.com/college/2019/08/07/ncaa-college-basketball-agent-criteria-rich-paul-nba-draft

nothing says educational priority like a bunch of old white guys twisting their rules to make sure the poor black man has absolutely no say in how his future should unfold. instead of saying the agent had a college degree, they should have simply said only white middle aged lawyers from proper ivy league schools who refuse to acknowledge social injustices should be permitted to act as agents for basketball players in the ncaa. it would have been more honest.

The almost never discussed question is why doesn’t the Federal government lock in extremely low rates with 50 bonds?

The almost never mentioned answer is that American bond brokers would rupture collective spleens. Bonds may ostensibly be about raising capital, but in practice far more about profits…

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/yellen-faces-major-hurdles-to-issue-of-50-year-bond-that-mnuchin-passed-over-62228383

An NYT article said that Mnuchin had toyed with the idea, then dropped it claiming lack of demand. I have no feelings on it, other than it is an interesting topic.

As it relates to America paying back it’s high debt, I’ve always found equity warrants to be an underrated idea and underrated topic. What if America had KEPT a huge chunk of Goldman Sachs equity back in 2008, possibly even in perpetuity for bailing them and other banks out?? You lower executive compensation and pay yourself (Uncle Sam) a dividend. Other than the complications of “who is the custodian??” or caretaker of the funds/equity, I’ve yet to figure out why that’s a horrible idea when outfits like Chrysler would be dead by now, if not for the U.S. taxpayer. I’ll tell you this much, Goldman Sachs, Bear Stearns etc would run a much “tighter ship” if they knew there’d be salary claw-backs and equity in the outfit that would never go back to executive options or quiet executive freebies at quarterly/annual meetings.

Gee – nationalize the banks. No one ever said that before (except folks like me and Krugman). You are only 13 years late to the party.

timing is one issue. management must agree to these terms. and no manager is going to agree until it is effectively too late, essentially in bankruptcy. but for the overall financial market, bankruptcy of a major financial institution is far more impactive than that of a automobile manufacturer. i agree with your sentiment, moses. but the people who run financial firms would rather sink the ship than forfeit and admit they failed. example jimmy cayne.

Japan has 40 year government bonds.

I have not double checked recently, but it is my understanding that there are still some infinite time horizon British consols out there getting interest paid on them that are over a century old. Not sure when UK stopped issuing those, mostly a Victorian thing when Btitish Empire ruled the world without question.

I have now double checked. The first British consol bond was issued in 1751. A lot were issued in the late 1800s and some to help finance WW I, with the last issued at behest of Churchill in 1927. These all had the character that the UK government could redeem that any time of their choice. Most of them had interest rates ranging from 2 1/2 to 4 %, with the original ones issued for 3 %. Apoparently the US also issued some in 1870. I know nothing more of those.

Anyway, they no longer exist. The UK government redeemed the final batch of 4% ones in 2015, so not all that long ago. Guess they decided the interest rate was just too high.

“Guess they decided the interest rate was just too high.”

The funny thing is that if they redeem them at fair market value, the bond holder got a hefty premium over face value.

pgl,

I suspect they did not, but I do not know.

Actually I suspect they paid them off at their face value, which would be legal and would not be their market value.

I’m using news from a dot cn site because I don’t want the white devils taking over here:

https://www.globaltimes.cn/page/202105/1224997.shtml

Luckily we can blame this on the Laowai of India, so wipe the sweat off your brow comrades

http://www.xinhuanet.com/english/2021-06/01/c_139983069.htm

June 1, 2021

Over 660 mln COVID-19 vaccine doses administered across China

BEIJING — Over 661.4 million doses of COVID-19 vaccines had been administered across China as of Monday, the National Health Commission said Tuesday.

[ Twenty million doses of 5 domestically produced vaccines are now being administered daily in China. ]

http://www.xinhuanet.com/english/2021-05/31/c_139981227.htm

May 31, 2021

How Chinese COVID-19 vaccines are boosting Serbia’s recovery

— The China-developed vaccines have showed reliability that “no one could have expected in difficult times and circumstances,” Serbian Prime Minister Ana Brnabic said at the reception of the latest batch of Chinese vaccines last week.

— Support from China also included advice of the best Chinese experts and doctors who helped Serbia combat COVID-19 and technological equipment for Serbian hospitals, doctors, and nurses.

— Official data shows that notwithstanding limited production capacity and enormous demand at home, China has honored its commitment by providing free vaccines to more than 80 developing countries in urgent need and exporting vaccines to 43 countries….

[ There are now 2 Chinese coronavirus vaccines approved for use by the World Health Organization:

June 1, 2021

https://www.globaltimes.cn/page/202106/1225133.shtml ]

“showed reliability that “no one could have expected in difficult times and circumstances,” Serbian Prime Minister Ana Brnabic said at the reception of the latest batch of Chinese vaccines last week.”

i have a fondness for the serbian people. just like the chinese people. but both nations have governments that i would trust as far as i could throw.

Ever noticed how ltr just ducks the efficacy of SinoVac issue over and over. Some quote from a Serbian leader is not exactly the same as what the medical experts say and ltr knows this. She has a serious credibility problem here.

Ah, nice that the Serbs are grateful. Too bad they are not in the EU so that they can help try to convince its leaders to get back to negotiating the nearly completed trade and investment deal with PRC that EU leaders scuttled because of the aggressive criticism that PRC diplomats engaged in against them when they made relatively mild criticisms of the PRC policies regarding the Uigjhurs in Xinjiang, even though the EU leaders held back from making the judgment the US government has made that this policy constitutes “genocide.” But, hey, now that he is planning to make himself a lifetime Supreme Leader, overturning the moderate and reasonable policy put in place by Deng Xiaoping that leaders leave after ten years, Xi Jinping has his diplomats showing no tolerance for any criticism or questioning of their policies, as various nations are now learning.

Please publish a graph of the actual interest cost percentage of the federal debt owned by the public. Since 1951 is my time period suggestion.

Here is a table except by Blanchard cut from the OMB’s latest budget. It shows two new lines in the budget — Real Net Interest and Real Net Interest as Percent of GDP.

It’s negative all the way out to 2028 and continues as a fraction of a percent of GDP thereafter.

It’s a political crime that we aren’t borrowing and spending trillions for the Green New Deal. It’s essentially free money with a high rate of investment return. Folks who say we can’t afford it are just flat out lying. The truth is we can’t afford not to do it.

https://twitter.com/ojblanchard1/status/1398563216809205760/

“Real Net Interest and Real Net Interest as Percent of GDP”.

This is the correct way to look at this. Of course the chief economist for Fox and Friends – Princeton Steve – is convinced that the debt/GDP ratio has to be exploding over the next decade even though the CBO has been crystal clear on its assumptions of the key determinants. Now I asked old Stevie to actually READ the CBO report but I guess if he did so, he would be fired by Fox and Friends from being too informed about reality.

https://fred.stlouisfed.org/graph/?g=ymEM

January 30, 2018

Federal Government Debt held by public as share of Gross Domestic Product, 1970-2021

https://fred.stlouisfed.org/graph/?g=EnFq

January 30, 2018

Federal Government Debt held by public as share of Gross Domestic Product and Ten-year Treasury, 1970-2021

https://news.cgtn.com/news/2021-06-01/Eurozone-factory-growth-input-costs-hit-record-highs-in-May-10K5VPTN5kc/index.html

June 1, 2021

Eurozone factory growth, input costs hit record highs in May

Eurozone manufacturing activity expanded at a record pace in May, according to a survey on Tuesday which suggested growth would have been even faster without supply bottlenecks that have led to an unprecedented rise in input costs.

The bloc’s economy has been ravaged by the coronavirus pandemic over the past year, with governments forcing much of the region’s dominant service industry to close. But factories largely remained open, and restrictions in various countries have gradually been eased.

IHS Markit’s final Manufacturing Purchasing Managers’ Index (PMI) rose to 63.1 in May from April’s 62.9, above an initial 62.8 “flash” estimate and the highest reading since the survey began in June 1997….

Chinese financial regulators are treating commodity cost increases as driven significantly by international traders and are intervening sector by sector to limit costs. Evidently Eurozone bankers have a similar perspective and consider the commodity cost increases being experienced by manufacturers as short-lived. Chinese bankers are in addition having financial companies increase holdings of foreign currency reserves from 5 to 7%.

“Chinese financial regulators are treating commodity cost increases as driven significantly by international traders and are intervening sector by sector to limit costs.”

Really? Princeton Steve and his cabal of traders are trying to inflate commodity prices for what reason? Oh yea – this is Stevie’s trick to get another appearance on Fox and Friends.

https://financialpost.com/pmn/business-pmn/china-securities-regulator-paying-great-attention-to-commodity-price-fluctuations-2

I had thought ltr was making this up but it seems the Chinese financial regulators are indeed trying to constrain commodity price increases on their belief that traders are manipulating the market. I’m not sure these regulators are right here but I’ll defer to our host to comment on this controversy.