The Obamacare Effect: Top US Insurers Reward Shareholders As Healthcare Costs Climb

Consider it a uniquely American approach to offering healthcare. In the three years since the U.S. Supreme Court ruled in favor of the Affordable Care Act’s coverage requirements, the nation’s top health insurers have reaped a windfall.

As insurance premiums and healthcare costs continue to increase, the balance sheets of major health insurance providers show not only a surge in revenue and profits, but also a startling increase in the dividends they pay to shareholders. The system aimed at expanding healthcare to millions of Americans is also handsomely rewarding insurers and their investors.

Financial statements from the nation’s top three health insurance providers show an average revenue increase of 43 percent from 2010 through 2014. Meanwhile, UnitedHealth Group Inc (NYSE:UNH), Anthem Inc (NYSE:ANTM) and Aetna Inc (NYSE:AET) increased shareholder dividend payments from a combined $465.1 million in 2010 to $2.12 billion last year, a 356 percent jump. And in 2014 alone, the three companies spent more than $8 billion in stock buybacks.

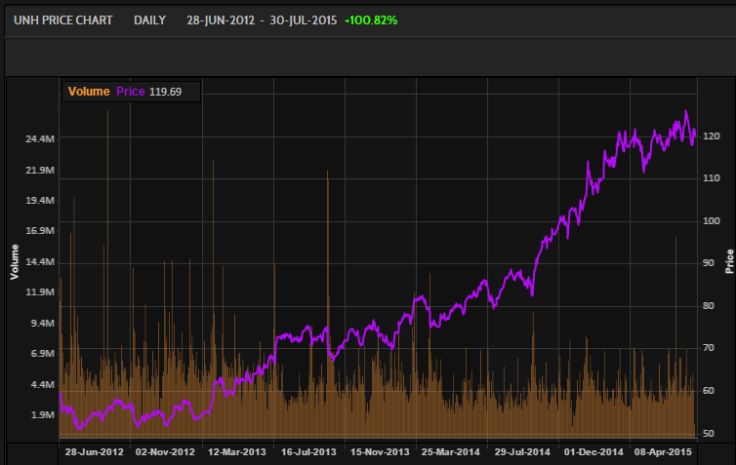

Since the Supreme Court’s June 28, 2012, ruling, UnitedHealth Group’s stock price has leaped 101 percent while Anthem’s and Aetna’s shares have risen 135 percent and 186 percent, respectively. During the same period, the Dow Jones Industrial Average rose 40 percent while the S&P 500 Index gained 58 percent.

The rally comes as federal data released Tuesday shows healthcare costs increased 5.5 percent last year, the biggest rise since 2008, and will continue to increase by an average of 5.8 percent a year through 2024. Per capita private insurance premium growth is expected to slow to 2.8 percent this year, but a greater number working Americans are paying higher deductibles. Meanwhile, workers' wages have stagnated.

“If you look around the world at other big economies, they treat health care as a right and they try to control costs because the market doesn’t do that,” said Richard Kirsch, senior fellow at the Roosevelt Institute, a progressive nonprofit group. “One of the things that we’ve faulted about the Affordable Care Act it that the out-of-pocket costs and premiums are too high.”

Kirsch, who says he favors Obamacare in general, notes that larger problems in the economy have made it difficult for many working Americans to get affordable health plans. While low income and unemployed Americans receive government subsidies, many working Americans earn too much to qualify for significant assistance under the act.

A national survey by the Robert Wood Johnson Foundation released in June found that almost 8 out of 10 uninsured Americans who sought coverage in the previous 12 months said they couldn’t find a plan they could afford. Most of the survey respondents were employed and said they had less than $100 left every month after paying bills and less than $100 in savings.

To be sure, the Affordable Care Act has brought health insurance to millions of people. A Gallup poll concluded that the percentage of uninsured adults in the country has dropped from 14.6 percent in the first quarter of 2008 to 11.9 percent in the first three months of the year. But compared with other developed nations, the uninsured rate is still alarmingly high.

A 2013 report from the Organisation for Economic Co-operation and Development (OECD), the global organization tracking the top 34 most industrialized countries, found that the United States ranked at the bottom of the list for achieving universal health coverage for all of its citizens. Out of the 34 countries traced by the OECD, 20 had 100 percent coverage and six had coverage above 99 percent.

Even with the gains made in the past couple of years, the U.S. remains in a club that includes Estonia, Mexico and the Slovak Republic in terms of the proportion of citizens who have neither public nor private health insurance. And it’s the only country on the list that relies so heavily on the private sector to extend health benefits to its people.

Mireille Jacobson, associate professor of economics and public policy and Director of the Center for Health Care Management and Policy at The Merage School of Business, points out that rising costs have at least one benefit: They coincide with improved quality of care.

“One thing that people in the healthcare debate lose a little sight of is this: healthcare costs were less in 1960, but you wouldn’t want the healthcare from 1960.”

© Copyright IBTimes 2024. All rights reserved.