It seems pretty obvious that when the economy is weak individual’s earnings go down, and unemployment goes up, consequently tax revenues go down. After all, if people aren’t making any money they can’t give it to the government. So, it seems logical to ask about falling tax revenues and rising deficits. In today’s article, Ryan McMaken looks at the current situation.~ Tim McMahon, editor.

If the Economy Is So Great, Why are Tax Revenues So Weak?

Federal deficits continue to spiral upward, but deficits aren’t just a function of federal spending. Deficits aren’t necessary if tax revenues increase to match spending. But that’s certainly not where we find ourselves in 2023. Rather, federal spending is rising even as federal revenues have fallen, year over year, for ten of the last twelve months. Moreover, on a quarterly basis, federal receipts have been falling—quarter-to-quarter—since the third quarter of 2022.

It’s long been known that there’s a pretty strong correlation between falling tax revenues and worsening economic conditions. Yet, even as tax revenues are falling, we’re being repeatedly told that the American economy is in great shape and there’s no recession in sight.

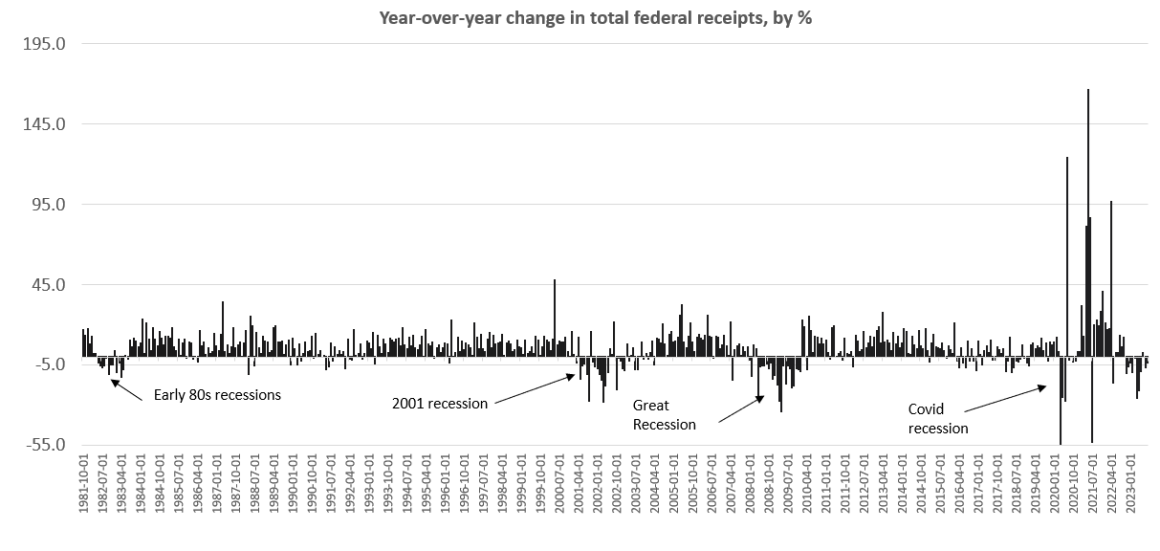

Yet, if we take a historical view, we can see how declining federal revenues have clearly coincided with recessions going back at least 40 years:

There have been some periods where revenues went slightly negative without an accompanying recession. But not in many decades do we see a situation where year-over-year revenue has fallen to the extent that it has fallen in recent months, without a recession following soon after. (For example, federal revenue dropped 26 percent, year over year, in April of this year, followed by a 21-percent drop in May.)

There have been some periods where revenues went slightly negative without an accompanying recession. But not in many decades do we see a situation where year-over-year revenue has fallen to the extent that it has fallen in recent months, without a recession following soon after. (For example, federal revenue dropped 26 percent, year over year, in April of this year, followed by a 21-percent drop in May.)

Most of the corporate media’s declarations of excellent economic conditions look no further than the trailing indicator of employment or consumer spending. Consumer spending, of course, continues to be fueled by rising debt levels while investment falls.

Tax revenues present a problem for the everything-is-swell narrative, however. This can partly be explained if we consider that federal revenues nowadays are heavily reliant on income taxes and payroll taxes. So, if wages and job growth were truly surging as the Bureau of Labor Statistics insists via its payroll survey, we’d be seeing more growth in taxes on wages and income. The fact federal revenues are falling suggests household incomes aren’t exactly soaring.

The fact tax revenues are weak and falling should not shock us if we’re actually paying attention, however. Real wages are lower now than they were in January 2020, before the beginning of the covid recession. Looking at CPI-adjusted average hourly wages, wages increased a whopping two cents from September 2022 to September 2023. Wages are down by .06 percent since January 2020 before the lockdowns. In other words, real wages have gone nowhere in years.

There may be a multitude of other factors as well, of course, but no matter what the specifics are, it’s difficult to deny that falling or weak tax revenues contradict narratives telling us how strong the economy is. Moreover, consumer spending as we now see it is also coinciding with a surge in corporate bankruptcies, a falling saving rate, and mounting consumer debt. The index of leading indicators is in recession territory. The inverted yield curve points to recession, and money-supply growth has crashed to its lowest levels since the Great Depression. Who would be surprised that tax revenues fail to impress? Only mainstream journalists and establishment economists.

This article originally appeared here and has been reprinted under the Creative Commons license. ![]()