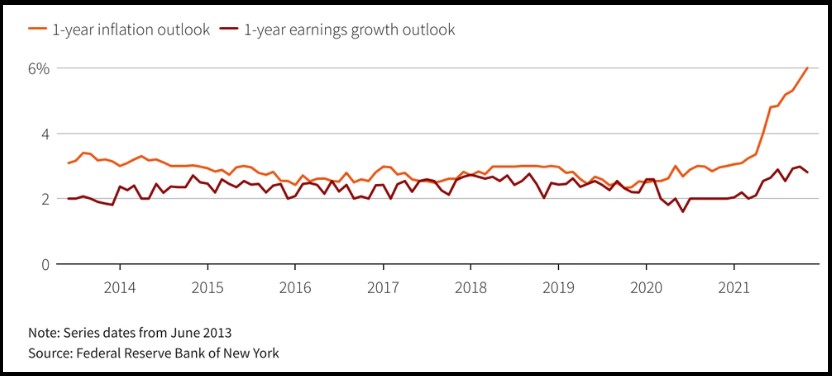

The New York Federal Reserve survey reflects the obvious. Consumers see staple food and energy price increases far outpacing any wage gains, and the outlook moving forward does not show signs of improvement.

The distance between the inflation line and the wage line is the intensity of the hurricane coming our way.

We are in this very weird place where the politically motivated Fed cannot stop purchasing debt created by legislative spending. At the same time, the political Fed is going to have to raise interest rates or we will enter an impossible spiral of policy caused inflation. There are three options: (1) stop buying debt; (2) increase interest rates; or (3) deploy some COVID mechanism to shut down people and hit the demand side.

Considering that Omicron didn’t work, and further panic pushing does not seem politically viable, that only leaves the two options of the Fed stops buying debt, and/or the Fed raises interest rates. Now, considering that these same political ideologues will not stop pushing the Build Back Better legislative agenda, that means the Fed cannot stop buying debt. That leaves one option remaining, increase interest rates.

Dec 13 (Reuters) – U.S. consumers’ short-term inflation expectations pushed higher in November and expectations for future earnings growth dropped, suggesting they anticipate price increases will outpace wage gains at an even faster rate in the near term, according to a survey released on Monday by the New York Federal Reserve.

Prices for food and other goods are rising at the fastest pace since 1982, according to data released by the Labor Department last week, posing political challenges for President Joe Biden’s administration and cementing expectations the Fed will raise interest rates next year. (read more)

Pretty sure I remember seeing US coupon bonds at 13.75%

I had a CD that got 12%. It was great. Savings rates were through the roof, and thanks to all the savings, and savers being rewarded for their savings, the boom of the 1980s was possible. Now, nobody saves because the FED artificially keeps rates WAY LOWER than they would be given the atrocious savings rates, all because they have become the lender of FIRST RESORT. Sound and honest banking would have interest rates MUCH higher, so savers were rewarded instead of being victimized. End the Fed. Government is the greatest evil ever created by man.

Yes, Mr. Liberty, I was there in Seattle in ’81 and ’82. That winter was horrible. No work at the hangar and inflation through the roof. We had no savings then. And couldn’t buy a house as interest rates were 20%.

Since the Federal Reserve absent the open market committee is essentially a giant clearing house for the banking system and the only impact the Fed has on the market besides some minor regulatory impact while the major regulations come from the Comptroller and other regulatory agencies under alleged legislative oversight is through the open market committee. The FOMC is what sets monetary policy and executes it through buying and selling in the market on their own behalf. Printing money as it is called occurs when they buy securities thus exchanging cash in return and putting more cash into the system. This is how they depress interest rates. The opposite occurs when they sell securities and thus take cash out of the system. This pushes rates up. They influence interest rates through their actions and the words and announced targets are simply signals or really just words. There is no option to raise rates when there is no option to stop buying United States Treasury Securities of whatever maturity. 2008 marked the first time in history they bought securities other than the aforementioned historically risk-free securities. They have bought many types since and still hold many they could never unload because, well, things kept needing a push you know to help the economy. They are stuck. Monetary policy can only run one way if no one else is willing to buy what the U.S. Treasury is selling except the Fed. The mortgage backed securities they bought on the cheap before the accounting rules got changed back to end the financial crisis that was never really a crisis are worth their book value again at least. The usual suspects pushed too much leniency into the credit risk being taken on by Fannie et al. and pushed it onto Wall Street. The bottom line is they cannot raise interest rates to help stop inflation without changing course on open market activity and thus causing a large recession to finally get the balance sheet of the Fed back where it belongs. The choice is which evil. Inflation or recession. There is no other way out. The politician always votes for inflation. Kick the can down the road further. If they are too dense between the ears or too intoxicated with their own will and dominion they keep spending even more and the central banker keeps buying it and the value of the currency swirls the bowl. I for one don’t think there is enough over demand to give up with more lockdowns and such. Most people are down to mostly essential activity already and cannot stop eating or going to work or fixing their car to get them to work etc. There is no excess demand. Just pissing everyone off even more.

Not reading this. Try breaking down you points in paragraphs that can be absorbed.

He did that so as to hide this gem: “ The mortgage backed securities they bought on the cheap before the accounting rules got changed back to end the financial crisis that was never really a crisis are worth their book value again at least.”

Hitchhiker could enjoy monopoly ownership of those those subprime, mortgage-backed securities because no one else will offer to buy them at book value, much less offer a premium.

You need patience. Don’t be lazy.

Try copying and pasting it, then you can format it to your specifications.

That was a really good post but I’ll add my comment to Arnie’s that it was ruined by being a nightmare to read and I suspect he wasn’t the only one to walk on by.

The site has guidelines on this subject.

“ The site has guidelines on this subject. ”

So did high school English class.

Try copying and pasting it, then you can format it to your specifications.

I believe I think I may know, or not, the intended or implied meaning or lack of significance in what you said, or may have said but didn’t say, or may have in any event implied, but however nonetheless notwithstanding the foregoing I may agree, in part, except to where I may disagree, in principal. In conclusion.

Exactly right. The choice is inflation or recession. Although, IMHO, recession might be understating the risk by a long way. In order to have a healthy economy, we NEED the regular cycle lows to keep the system cleansed. THIS IS CODED INTO THE ALGORITHM IN WHICH WE LIVE. There is no other way. When Alan Greenspan “saved us” back in 1987, he put us on the road to where we are now. Isn’t it ironic that a follower of Ayn Rand decided that, while Central Planning is bad, if he did it, it would work out fine? No one has dared to take us off that road Greenspan put us on thirty-four years ago. Now, of course, the excesses are so large that, as i said, recession might not be the correct term.

But, think about this in context with where we are today. Wonder why the people in power, especially in Europe, were so ready to take advantage of COVID? Wonder why, here in the US, the politicians jumped on it too? Climate change just didn’t scare the sheep enough to ge the job done. THIS IS ALL ABOUT DEBT. The financial world is imploding. Don’t believe it? What does a Bitcoin cost today? That pretty much tells you everything you need to know.

The “elites” have two options. One is to admit that they screwed up and accept accountability. The second is to take advantage of COVID to extend their power and tell the sheep they are “saving” them from this terrible virus that kills – what? – a fraction of one percent? Mostly old people who have other serious problems? Which option do you think they will take?

This is all about the elites desperately wanting to avoid accountability and retaining power. History is mostly a record of a group of people gaining and maintaining power over other people. Why should we ever think that today is any different?

Aaaaaaaand, not enough snow plow drivers heading into the winter so expect delays and more problems from winter storms, especially in states that get very severe winter weather. How’s everyone enjoying the new regime???! Ain’t it just grand?!

https://www.dailywire.com/news/report-shortage-of-snowplow-drivers-could-make-winter-travel-more-difficult

No problem, all those new expensive electric cars and trucks will be creating so much heat that there will be no need for snowplow drivers…that is if the extension cord is long enough.

Put plows on the school buses

I remember money market funds paying a 16% rate and overseas corespondent banks paying a little over 20% in dollar denominated certificates of deposit. And don’t forget the old 30 year bonds paying over 15%. Real monetary history of the early 80’s.

Raising rates takes the punch bowl away from Wall Street, but the party has persisted since 2008. Its time for the Fed to put on their big boy pants and do its job. I say go to 2% right out of the gate.

Not just Wall Street but Governments around the World who would see their interest bills rise, potentially swamping other claims on their funds, like health and defence.

Or they could just do nothing and change the way they calculate inflation – again.

I would say that the hurricane headed for New Orleans would be an even better representation. The Middle Class should be portrayed by a city below sea level as consumer debt and obligations far outstrip their wealth, while inflation is headed their way to finish the job. I never actually thought that so much government-created misery would befall this country while I was still alive. I knew it was inevitable, just not this close. I guess watching the republicans and the democrats do what they do, I should have known better.

Suppose the CVD/Vaxx mechanism has been planned to TRULY “shut down people” to hit the demand side? Surely it’s not purely coincidental that 2020 is exactly 65 years after 1955, the peak birth year of the Boomer generation?

Imagine the cost of Social Security and Medicare for all those retirees! and perhaps for another 15-20 years, as expensive medical procedures extend their lives! The cost savings from culling the old, the obese, and the weak would be very large indeed, and would free up resources for the communists’ other priorities…

The vaxx madness across the West makes little sense unless there is a larger objective behind it – and as a right-leaning Boomer, I do not find it “too much of a stretch” that some people (perhaps even within my own National government) might prefer to keep the money and see me gone. Maybe that’s why they keep repeating that this inflation is “transitory” – in the short term, nothing is as deflationary as mass death.

Apologies for being so dark…but we live in evil times, my friends, and blind trust in (whoever it is pulling these strings) would be dangerously misplaced. The past may not correlate to the future.

And what is the effect on the Federal budget of paying much higher interest rates on all their debt?