Dallas Fed tracks breakevens, lowest opex

The Federal Reserve Bank of Dallas released its Energy Indicators report, outlining the continued recovery of the oil and gas industry.

No surprise

Texas is the heart of oil and gas activity, with both the Permian and Eagle Ford driving tremendous amounts of production and activity.

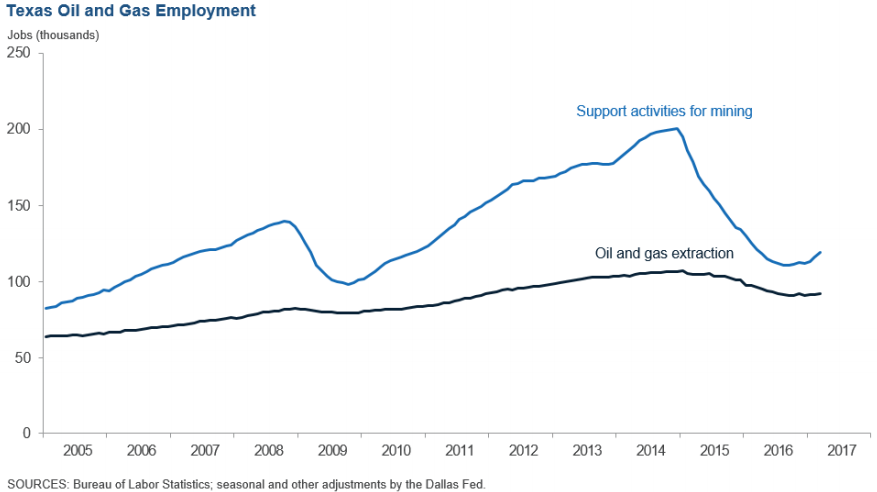

In total, the oil and gas industry employed about 211,700 people in Texas in March, up 3,500 from February. “Oil and gas extraction” jobs increased slightly to 92,500, while “support activities” rose to 119,200. Historically, employment in “oil and gas extraction” is much more steady than employment in “support activities,” as support activities saw employment drop by about half during the downturn.

Texas accounts for about 54% of all oil and gas employment in the U.S., as nationwide there are 181,200 people working in “oil and gas extraction” jobs and 208,200 people in “support activities.”

Fed finds lowest breakevens

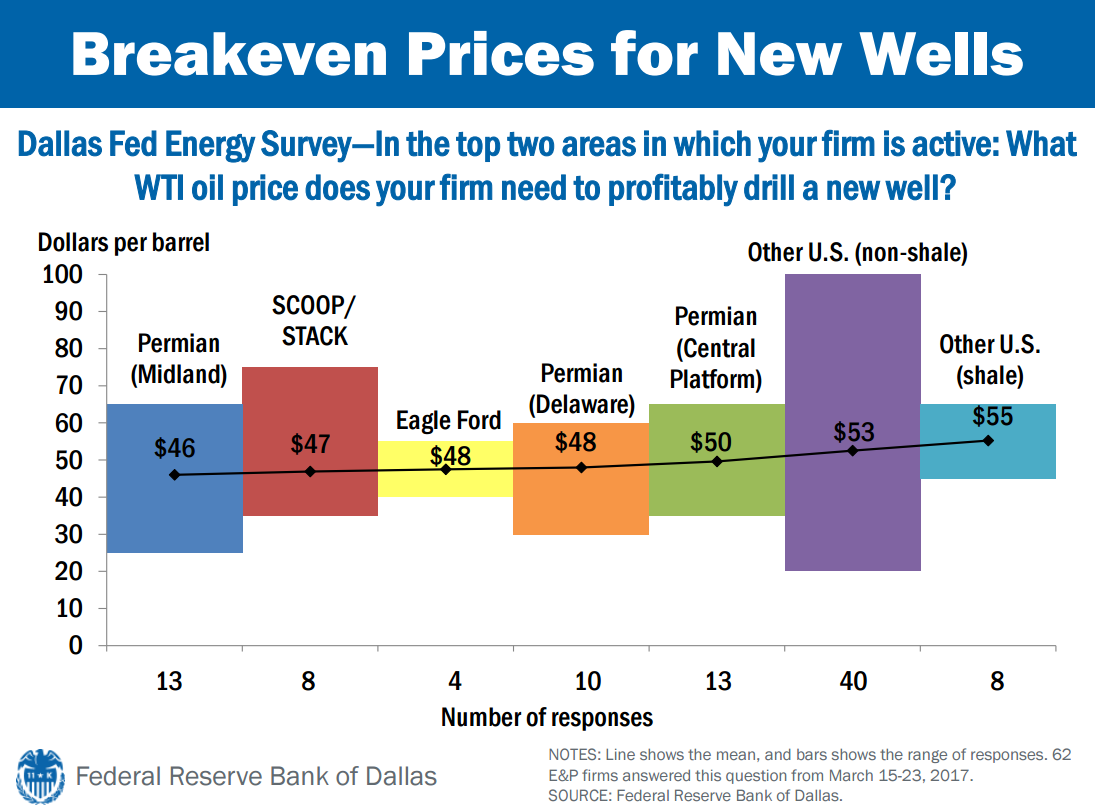

The current oil price is approximately at breakeven for new wells in the most prominent shale plays, according to the Dallas Fed Energy Survey. The fed asked 62 E&P companies “What WTI oil price does your firm need to profitably drill a new well?” in mid-March this year.

While results varied widely, here is a breakdown:

- The Midland area of the Permian emerged as the best play, with an average reported breakeven from $46/bbl in Midland to $50/bbl in the central platform.

- Oklahoma is still a factor, as the SCOOP/STACK was close behind with $47/bbl.

- The Eagle Ford showed the most consensus, with all results near the average of $48/bbl.

- Non-shale plays in the U.S. varied widely, with responses ranging from $25/bbl to $100/bbl, but averaged $53/bbl, slightly above current prices.

OPEX comfortably below oil price

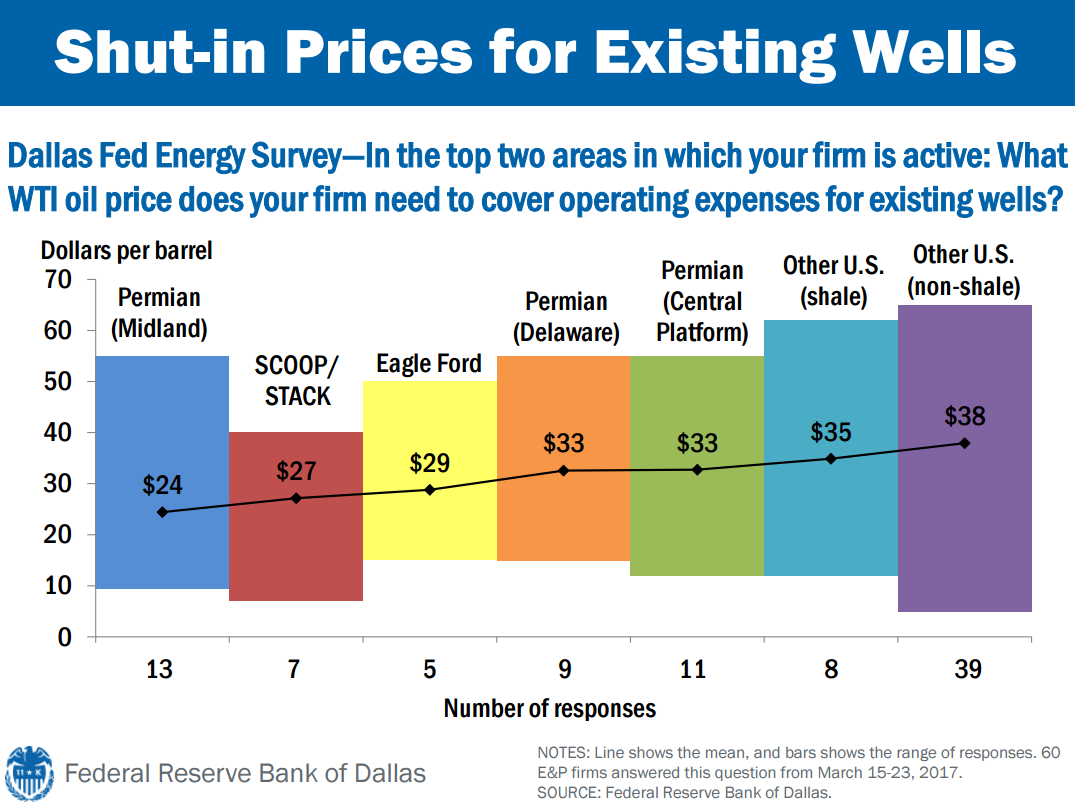

While oil price seems to be hovering around breakevens for new wells, companies will likely not be forced to shut in production any time soon.

The fed also asked 60 companies, “What WTI oil price does your firm need to cover operating expenses for existing wells?”

- The Midland basin was again the cheapest play, averaging $24/bbl needed to keep wells online. This cost would be covered even at the lowest oil price seen during the downturn.

- Like the economics of new wells, the SCOOP/STACK was a close second for lowest operating expenses

- Next lowest were the Eagle Ford and other Permian regions.

Even non-shale plays have OPEX comfortably covered, averaging $38/bbl. Firms active in the Midland, SCOOP/STACK and non-shale each reported OPEX less than $10/bbl, indicating the best spots in the plays may never be forced to shut in.