Archegos shows how leverage is the great accelerator of stock prices on the way up, and on the way down. One of its bets, ViacomCBS, after skyrocketing, collapsed by 60%.

By Wolf Richter for WOLF STREET.

Vast, unreported, and at the time unknown amounts of leverage blew up Archegos Capital Management, dishing out enormous losses to its investors, the banks that brokered the swaps, and holders of the targeted stocks. The amount of leverage became known only after it blew up as banks started picking through the debris. ViacomCBS [VIAC] was one of the handful of stocks on which Archegos placed huge and highly leveraged bets, thereby pushing the shares into the stratosphere until March 22, after which they collapsed by 60%.

Archegos is an example of how leverage operates: It creates enormous buying pressure and drives up prices as leverage builds, and then when prices decline, the leveraged bets blow up as forced selling sets in. Most of the leverage in the markets is unreported until it blows up. The only type of stock-market leverage that is reported is margin debt – the amount that individuals and institutions borrow against their stock holdings as tracked by FINRA at its member brokerage firms. Margin debt is an indicator for overall leverage, and it has reached the zoo-has-gone-nuts level.

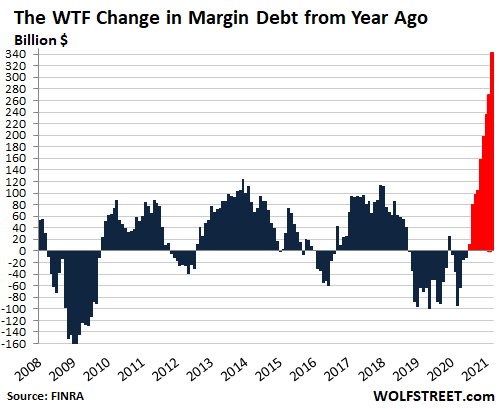

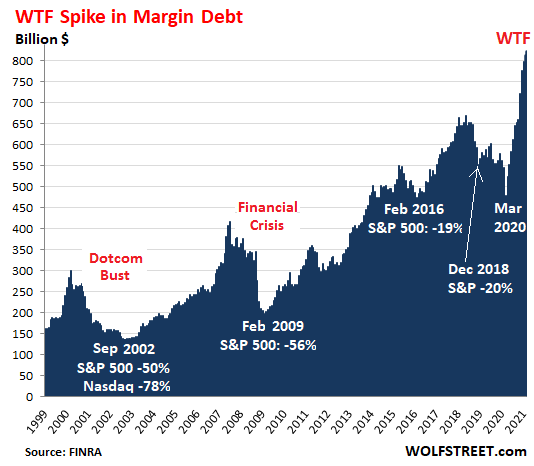

FINRA reported on Friday that margin debt jumped by another $9 billion to $823 billion in March, having soared by $163 billion in five months, and having exploded by 72% from March 2020 and by 51% from February 2020, to historic WTF highs:

Archegos is an example of how leverage is the great accelerator of stock prices, on the way up, and on the way down. Its massive bets on a handful of stocks, powered by huge leverage, drove up prices of those stocks because it created buying pressure with borrowed money. As prices rose, Archegos could borrow more to increase its bets. And then suddenly, when these stocks started selling off because other investors got out, Archegos got the margin calls, and leverage became the great accelerator on the way down.

While we don’t know how much total stock market leverage there is, we can look at margin debt as a measure of the trend. And the trend has reached whopper proportions. History shows that a big surge in margin balances preceded – and perhaps was a precondition for – the biggest stock market declines:

In a chart like this that covers over two decades, the long-term increases in the absolute dollar amounts are not critical since the purchasing power of the dollar with regards to stocks has dropped. What is critical are the steep increases in margin debt before the selloffs.

As the world has seen unfold with Archegos, the amounts of other types of stock market leverage aren’t known. Even Wall Street banks that deal with their clients don’t know about their clients’ total leverage at other banks. Each bank knew how much leverage Archegos had with it, but not how much it had with other banks, or that it had any leverage with other banks.

And when banks issued their margin calls – said to have been the second largest margin call in US history, after Lehman – and liquidated the underlying shares, they were selling those shares against each other. The first-out-the-door, including Goldman Sachs, came away relatively unscathed. Late movers, such as Credit Suisse got mauled.

That’s also a feature of leverage: The first-out-the-door pocket the gains and get away unscathed. Late movers get crushed.

And since everyone knows this, everyone is trying to get out the door first, which is not possible, but it speeds up the selloff.

Among the types of stock market leverage, in addition to margin debt, are derivative products, such as the swaps that sank Archegos, portfolio-based lending, and Securities-Based Loans. Each broker knows what they have on their books, presumably, but they don’t know what other brokers have on their books, and no one knows the total, and no one knows just how leveraged the markets are.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Ever notice the name of the hedge fund:

Arch Egos?

How fitting.

There too are other kinds of leverage besides those mentioned in the article. There are people who have refinanced there homes with new mortgages and put the money into the markets. There are people who have borrowed money on their credit cards at high interest rates to play the markets. There is the carry trade in the currency markets placed in other markets overseas where bonds may have been shorted at 2:1 or more leverage and then the money placed in the futures market at 10:1 leverage and then leveraged again on any gains into a brokerage account at 2:1 making the entire trade in some respects = to 30:1 to as much as 60:1 leverage. The central banks and their respective governments are enabling the whole thing and blowing up enormous bubbles.

There are also a lot of people who haven’t paid their rents and mortgages, and put that money into the market.

Also imagine at what leverage Softbank and Cathie Wood’s Ark are playing the market; I’m going to be just these are at least 10:1 leverage level.

The explosion of all these bubble will be so big that makes the crashes of 2000 and 2008 look like a child play.

There are also a lot of people who haven’t paid their rents and mortgages, and put that money into the market.”

Is there any evidence of this happening at any real scale?

Somebody just start a fund that is short Cathie’s Ark with 4X leverage. It could be named Itoldyouso. Or Noahdrowned.

Amen. It is hilarious and I will not elaborate and inadvertently help opponents, but the popping of the US’s bubbles and then the debt-fueled collapse is probably being delayed temporarily by the fear of a certain threat. That threat has its own problems, which prevent its taking strong action against our financial markets.

The loss of the US dollar’s reserve status may thus be delayed by the reliability of our current leaders. The smarter, justifiably terrified, wealthy, foreign investors can keep us afloat given the growing nature of the threat, so the hyperinflation and financial collapse that our Wall Streeters and the deceptively named “Federal” Reserve have caused may be kept in abeyance.

It is like a video from Africa that I saw in which the attack by one predator is inadvertently foiled by the attack of another predator on a helpless prey. Sadly, we are the prey. :-)

Therefore, I would not short things right now.

Accounting fixes this.

Dear Jacklynhunter,

Sorry but your Zen pronouncement only puzzles me, like the one about one hand clapping.

I guess I have always been interested in value investing which can make you a bit of a contrarion. In 2009 when people were scared and people were sitting on cash I was 99% in stocks with about 1% cash.

Now I am about 96% in cash or near cash and 4% stocks while margin debt is high.

You can make or lose money many ways, but valuing cash flows is the most logical to me.

I know that there are people who use credit cards to pay for gambling, but I have a hard time believing anyone does it. Thinking about it depressed me. Anyway, I’m at 50% cash now, time to increase that to 70-80% I think..

Where does one put their “cash” when they deleverage from the market. The cash and the ensuing liquidity crunch will bring crisis to the repo market. Will the fed bailout the big investor at the expense of the small investor? New prime money market rules seem to propose just that. To be truthful I am confused as to where to put my retirement savings. I need to eat for the next 30 years!

Dear Denise,

There are no absolutely safe investments now. Read about Enron and imagine that a whole lot of companies are probably using its accounting tricks now.

(Do not get me started on CCP controlled, meaning all mainland, Chinese companies. LOL. Burn your money instead of giving it to them.) Precious metals might get confiscated by a future, desperate, US government, as FDR’s order effectively confiscated gold from “hoarders.” LOL!

If you hold US dollars, the banksters in the “Federal” Reserve will “luv” you “long time” and secretly thank you for your generous (if inadvertent and unknowing) gifts to them. Your dollars’ value will be happily used up as they keep printing (pardon me, “digitally creating”) US legal tender for their own benefit. They will treat you like Soviet soldiers treated pretty Berlin women when they invaded it but maybe more gently.

Go to one of the banksters’ meetings for the whole Alibaba and the Forty Thieves experience. Then, prepare to eat out of garbage cans in your old age as the banksters’ “Fed” inflates your dollars and uses the value of your and other, gullible Americans’ money to buy worthless investments of the banksters (like the $2 TRILLION plus (face amount) in UNCOLLECTIBLE, mortage backed securities (“MBS”) that their “Fed” just bought from them for the full face amount by creating US dollars), to give ultra low-interest loans to legally insolvent banksters and their crony Wall Streeters, to pay “Fed” “dividends” to the banks for the “privilege” of bailing them out when they are legally insolvent, enabling their gambling in derivatives, MBS, guaranteeing their finances, allowing fractional reserve banking, etc., etc.

If you want to preserve whatever value your savings still may have that the banksters and their crony Wall Streeters have not already “taken” or stolen, do not hold any large amount of US dollars as hyperinflation may be about to take off– sooner or later. Go to shadowstats and view the alternate inflation charts.

Amusingly, terrified foreign investors are probably keeping the US dollar as a reserve currency for a while longer.

@K

Very nice and concise summary.

Can you translate it into a popular form that average plebs could understand?

I try to read Buffet a lot. I think he has the opinion that when things lock up there is no substitute for cash and that comes in only two forms 1) cash in your possession and 2) treasury bills. If you buy things in dollars you got to have a ready reserve of number 1 or 2.

Exactly. It is way more scary than even Wolf’s charts suggest because there are so many layers of leverage stacked on top of each other.

People taking out margin debt on stock portfolios that they bought by re-mortgaging their bubbled houses to buy stocks with record corporate debt, collaterised (if at all) with bubble assets, at record valuations driven itself by leverage etc etc …

It’s just unbelievable that central banks are actively encouraging this.

“It’s just unbelievable that central banks are actively encouraging this.”

Indeed. It’s QUITE believable that the politicians love the free money and would never be bold enough to say….

“Hey Fed. Your mandates say you are to FIGHT inflation (stable prices) NOT PROMOTE inflation.”

The amount of margin debt is not a WTF amount if you use the prices-double each 11 year rule of thumb.

This 11 year period is strikingly accurate if you take the price of the New York Times since 1900 (I have a booklet with frontpages of each year and discovered this when looking at the selling prices)

Having said that, the current 800B is the same as the previous inflation corrected peaks of 2009 and around 1999.

So yes, Wolf is 100% correct with the prediction on what is coming. It is just not a WTF amount but a history-repeats-itself moment

Good point. Many times we look at charts and say WTF but once you normalize to inflationary, maybe not as bad as originally it appeared

“normalize to inflationary, maybe not as bad as originally it appeared”

I know what you mean, but…

then the (major) problem is that the inflation itself shouldn’t be viewed as “normal”.

Kinda reminds me of a gvt program defending doubled budget over 8 yrs because of “inflation” when in point of fact it is likely that G printing/policy has *created* the inflation in the first place (to help fund the program now pointing at inflation).

Also, reminds me of an abusive husband telling his beaten wife, “See what you made me do!”

Hussman says the right way to do that is to look at margin debt to gdp which is a record. GDP is doubling rate is about every 20 years now at nominal 3.5%.

Sorry, new here. What does WTF mean here?

American slang for ‘What the Fxxk”

That description applies to most Wall Streeters and banksters, whose titanic egos are amazing given the fact that most are parasites that contribute less than a woodlouse to society. Still, I dread the coming US debt collapse discussed in this website, which I would term a debt explosion as all of the bubbles start to pop and so many debtors and former creditors (like lessors, banks, etc.) become publicly known to be legally insolvent.

It is unfortunate that it may happen at the worst possible time, when we face an adversary worse and more powerful than the Soviet Union or Nazi Germany ever was. I have invested carefully but we will all lose much or most of our savings. It is very irritating to think of the trillions that the banksters’ deceptively named, “Federal” Reserve has been transferring to its ultra-rich owners for decades. They will probably even avoid most taxation again.

I do not like to even think how many Americans will wind up. Remember the saying “There but for the grace of god, go I.” Many of us will be saying that a lot in the coming years if we are very fortunate.

Assume you’re referring to China? China has made it very clear, by its actions, that it wants to take over the world and be a superpower again. They’re playing the long game. The only question is when they make their move.

Ultimately, it’s not as simple as “trade their stuff for our dollars and buy up our real estate/companies” because if things get bad enough here, we’ll nationalize all foreign held assets. They would need to use military force.

China only has to sit back with popcorn and watch America destroy itself, and they know it.

China made their move in 1949. They have a very long term view. Thousands of years of continuous history does that to you.

“I do not like to even think how many Americans will wind up.”

The average clueless American sadly likely will not fare too well as this End Game wends its relentless way to a reversion reset state.

When this debt tsunami is over those who went ‘all in’ on this carnival spectacle of national debt and spendthrifts will be clinging to the flotsam and jetsam of their pitifully reduced ‘assets’, or will be simply wiped out.

The question is, will non-fiat currency alternatives like cryptos (especially Bitcoin and precious metals) be safe haven life preservers after the deluge? Bitcoin right now is IMO hyperinflated and gotten ahead of itself, and that is definitely not a good sign for a purported stable ‘store of value’ asset.

Perhaps historically that Weimar hyperinflation event gives us some intriguing evidence of what might transpire here. No, it wasn’t the end of the world for the Germans of that era (they bounced back rather quickly as a nation) but a lot of everyday people suffered and a lot of wealth evaporated into thin air.

“No, it wasn’t the end of the world for the Germans of that era (they bounced back rather quickly as a nation)”. Please think again. What happened after was one of the darkest chapters of mankind.

“That description applies to most Wall Streeters and banksters, whose titanic egos are amazing given the fact that most are parasites that contribute less than a woodlouse to society. ”

Given historical facts, same “Wall Streeters” with their “titanic egos” might be, in fact, working for China and maybe Russia by debasing the USD via inflation and boosting both cryptocurrency as well as a soon unserviceable US national debt.

Indeed, it takes massive egos that have crossed the line in recklessness to deal in such markets in that manner. Problem, is that they will hurt many people through “osmosis” in due time. In addition to the items pointed out in the article, two additional items that are beyond comprehension:

1. The so called “Buffet Indicator” (Market Cap / GDP) now over 200%. I believe -from memory – in Dot Com bomb bust was around 156% and, at housing crisis around 140%

2. Schiller PE indicator – I believe around 37…again from memory only a few times above 30.

The destruction that has taken place has simply been ignored and, all the “bombs” like Archegos that are under the surface and that won’t come to light until a big problem exposes them.

The insanity continues until it doesn’t. It is world wide, but our corner of the world does seem a bit more outrageous.

I wish my wage growth is like this stock market chart…sadly there’s never been a WTF moment in my earnings compare to the market. That’s what I get for pursuing a normal job that produce something rather than pushing money around to multiple it from nothing..

Learned some new things about margin debt. Thank you.

It is unbelievable that firms only know and track their own client margin debt. How so? Try this with a mortgage. Imagine multiple second mortgages no one knows about collectively. Where are the rules and laws.

And now on mortgages in Canada 90% first mortgages are a norm. A few add second mortgages that actually exceed 100% LTV…. to have play money for a new SUV.

Headshake.

Jobs are for suckers, just like junk bonds that pay yield at reasonable inflation expectations. Waiting for “investors” to start holding their breathe until they pass out. You know, for the health benefits.

Phoenix_Ikki

Don’t feel so bad. We’re working for the VA for about $10/hour when all expenses are deducted. We could make more as a clerk at McDonalds.

SC – thank you for working at the VA.

There is a bias that asset inflation is “good” while wage inflation is “bad”.

This basic problem is and reinforces huge economic imbalances now – low wage inflation has been very unhealthy for our economy in the long run.

Bad deals never last ! Eventually we will reward hard work again instead of those getting over-rewarded now.

The problem is everything seems so expensive

that to move from one asset class to another

seems pointless.

Gold is unloved.

Yup, which is why I still have a bunch of it. Play the long game.

Yessir…but don’t forget some AG.

Unbelievable. It will end well.

It always does …. for someone.

Random people are explaining to me now that stock market wealth “just multiplies” so we gotta be near the top…right?

I have heard three acquaintances/friends want to “start day trading because they know a guy that is doing really well with it” in the last few months.

Makes me want to sell stocks, not buy them.

Lumber futures have gone up 50% in the past month, 400% YoY, adding 25K+ into the construction of a new house.

So much liquidity in the system…

The lumberyards are full to the brim. Demand is shrinking. This one will pop spectacularly just like oil. Lumber is big, difficult to store.

Where can we get stats on lumberyard inventory? If this is true – this is a big red flag.

Just an anecdote, but relevant to the conversation. Was quoted $20 linear foot on a CVG Cedar Fascia board 10x2x18′ two weeks ago. Went in and bought it at the same store yesterday and paid $16 per linear foot. 20% difference in 10 days. I was surprised to say the least. I think people are cancelling building projects until some sanity in pricing returns.

Wellstone’s Ghost, that’s how it always goes. People keep bidding up assets because they always go up. And builders are willing to pay any cost for lumber, because the houses are selling for so much that it’s worth it, even at the increased rate. But then a crack (figuratively) appears. It doesn’t have to be anything amazing, but someone decides that the costs are not worth it, and the seller can’t get a new person to buy that house at the higher rate. They are forced to drop the price, just a little bit at first.

And then other people, who were holding on to empty houses as “investments,” realize that the top may be near, and list theirs, so they can get out at the top. A bunch of other people watch what’s going on, and do the same. Suddenly, there is a ton of inventory, and not nearly enough interested buyers (at least at those prices).

That’s how bubbles pop. And while I described a housing bubble, the same concept applies to any asset.

Random Lengths Weekly Market Report is now behind a paywall unfortunately.

I’m guessing lumber prices are about $1,300.00 per MBF right now. To put this in perspective, the cost of timber, including sheathing on the walls and roof, for a conventionally built home of 1600 sq.ft. plus a 2-car garage would be about $16K. Add another $5K if not on a concrete slab.

In normal times timber runs about $500 per MBF. It has usually been a great bargain IMHO.

The high price of lumber isn’t impacting the construction of new homes so much as it is all of the small deck, fencing and outbuilding projects. Those are being canceled in large numbers. It is going to seriously impact the local hardware/lumber stores.

Don’t worry its only a few months until fire season.

The greatest transfer of wealth in history deserves a market at extreme high.

From lower class and middle class savers to the wealthy.

So much……. For moving up in the land of opportunity.

maybe if they’d stop transferring their wealth to wall street and the government via savings in equities and cash they would be wealthy too. but for some reason the obvious is always unbelievable.

they are enticed by the tax deferred status of retirement vehicles ($401k’s, IRA’s, etc.), and school savings accounts (429’s), and certain insurance products. to do what they do – invest in the stock market. Wall Street has been subsidized by the tax code and regulations against the majority of citizens.

yup. erisa act. it’s a way to shovel dumb money at wall st. don’t take the bait is my advice.

even worse, affordable care act (can barely write the name without laughing) . i wonder if insurance companies liked mandating the purchase of their product?

both were ways to shift huge pools of money towards already greedy institutions as far as i can tell.

but the 401k system is responsible for creating this mass confusion regarding the difference (or lack thereof) between saving and investing.

We should focus on what we don’t know. Who was holding those Swaps? Were short, or hedge positions taken, possibly outside the group of institutions which got burned. These brokers used block trades to get out of their positions, a block trade is done at the current market price, so if A sells a block of shares of XYZ to B, (marked to market) and B sells a block of ABC back to A, they have a quid pro quo, but nobody is talking. Earnings came out and the Wall St bankers are blowing the doors off expectations. Can you feel their pain? We also don’t know if perhaps the Chinese government orchestrated this, or if Hwang himself who was leveraged 10-1, didn’t put on a big short and dump the position in order to get maybe half of the money back into his account, (more than he really owned so still a profit) or some close relatives, or PBOC sanctioned bank. This scam was done per usual on the American taxpayers dime. This one got under the radar much too smoothly to be what it seems. The banks are probably using FDIC to cover their/his losses.

Hwang is a …. KOREAN AMERICAN. PBOC? Goldman and MS originally didn’t want to do business with this guy, but seeing the lucrative profits, they jumped in with both feet i.e. “greed is good”.

Next you’ll say that the mortgage crisis was also a PBOC creation.

With friends like these, who needs enemies.

Masayoshi Son is also Korean.

He was born in Japan, as were his parents. His grandparents were born in Korea.

Agreed, this is ludicrous speculation. Maybe China did it! As if Wall Street hasn’t been capable of this idiocy all by itself.

Not to mention how our pension funds just love losing boatloads of money to the Private Equity industry. KKR, Apollo, Blackstone … see any Asian faces among the CEOs?

The PE industry alone has destroyed more of America than any external enemy ever could. But no, everything is obviously either China’s or Russia’s fault. The two countries are not our buddies, they never will be, but only Americans can come up with something as cynical and destructive as Private Equity. Heck, speaking about swaps, that’s also Made in America.

Ambrose must be a Deep State operative.

@Monkebusiness. Spot on. private equity has been very bad for the middle class and extremely good for the employees of PE firms. If people only new the details.

Does not matter

Bottomline is stock prices are manipulated both up and down (shortselling hedges)

You have the story of sesame open or ali baba or whatever and the guy get killed because he stays too long and becomes too greedy.

So stay away from high p/e’s or speculative future earnings. Or if you want to get fancy, search for things that will have steady earnings like utilities or energy producers (like those poor bastard coal miners who are shorted beyond believe by all the latte sippers driving around in their coal-fired-electric cars). Anyone who produces and who will continue to fill a need.

“The Great Crash 1929” John Kenneth Galbraith

“By early 1929, loans from these non-banking sources were approximately equal to those from the banks. Later they became much greater. The Federal Reserve Authorities took it for granted that they had no influence over these funds”

He’s talking about “shadow banking”.

They couldn’t control the lending from shadow banks in the 1920s either.

They thought leverage was great before 1929; they saw what happened when it worked in reverse after 1929.

Leverage acts like a multiplier.

It multiplies profits on the way up.

It multiplies losses on the way down.

Today’s bankers seem to have learnt something from past mistakes.

They took the multiplied profits on the way up.

Taxpayers picked up the multiplied losses on the way down (2008).

Neoclassical economics was the economics of the roaring 20s, the Wall Street Crash and the Great Depression.

1920s financial problems are back.

Building the US economy on the foundation of the margin and derivative fueled stock market is like building your house on an ice sculpture.

I wonder if cbs is partly due to trumps boycott list. This is a genuine curiosity, not trying to start some sort of comment war here. I suppose if others on his list start to have issues we’d know.

I think both Delta Airlines and Coca-Cola have felt something.

Cancelled flights and Coke coolers full while Pepsi coolers empty.

This new form of corporatism where companies unabashedly promote political views is yet another sign of the times.

Taking sides and alienating a large portion of your customer base– can that end well?

If you think the portion of the customer base pushing for these things has the will and ability to destroy the others, maybe.

What could possibly go wrong with the markets?

In the 1930s, they found it was share buybacks and margin lending.

What lifted US stocks to 1929 levels in 1929?

Margin lending and share buybacks.

What lifted US stocks to 1929 levels in 2019?

Margin lending and share buybacks.

A former US congressman has been looking at the data.

https://www.youtube.com/watch?v=7zu3SgXx3q4

Today’s free market thinkers never get the 1930s updates to free market theory and this has been causing all the problems.

The US trusted free markets in the 1920s, but by the 1930s, the free market thinkers at the University of Chicago were in the doghouse.

The free market thinkers at the University of Chicago were just as keen as anyone else to find out what had gone wrong with their free market theories in the 1920s.

The Chicago Plan was named after its strongest proponent, Henry Simons, from the University of Chicago. He wanted free markets in every other area, but Government created money.

To get meaningful price signals from the markets they had to take away the bank’s ability to create money.

Henry Simons was a founder member of the Chicago School of Economics and he had worked out what was wrong with his beliefs in free markets in the 1930s.

Banks can inflate asset prices with the money they create from bank loans.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Henry Simons and Irving Fisher supported the Chicago Plan to take away the bankers ability to create money.

“Simons envisioned banks that would have a choice of two types of holdings: long-term bonds and cash. Simultaneously, they would hold increased reserves, up to 100%. Simons saw this as beneficial in that its ultimate consequences would be the prevention of “bank-financed inflation of securities and real estate” through the leveraged creation of secondary forms of money.”

https://www.newworldencyclopedia.org/entry/Henry_Calvert_Simons

Margin lending had inflated the US stock market to ridiculous levels.

Richard Vague had noticed real estate lending balloon from 5 trillion to 10 trillion from 2001 – 2007 and went back to look at the data before 1929.

Real estate lending was actually the biggest problem lending category leading to 1929.

The IMF re-visited the Chicago plan after 2008.

https://www.imf.org/external/pubs/ft/wp/2012/wp12202.pdf

When you use bank credit to fund the transfer of existing assets it pushes up the price.

This was the problem they had in the 1920s.

Share buybacks are another way of artificially pushing up the price of stocks.

Share buybacks were found to be a cause of the 1929 crash and made illegal in the 1930s.

Correct me if I am wrong, Wolf is telling us we are well into the ‘crack up boom’ and we should consider bailing out. At least those who are ‘all in’ or near to it. Good advice. Keep your powder dry as to go long Treasuries after the yields reach a maximum. Hold some precious metals if it all goes further south. Pay off debts and live a 1950’s economic life. What the hell else can we do?

The only thing you know is it will come , not when it comes

If you now go full treasuries and things fo not happen next week, all you do is loose money due to inflation and feed the Government spending beast.

Probably better to hedge a little. Never a good idea to put all your stuff in one basket

Diversification is a hedge against ignorance. You must work for Edward Jones.

Need at least two things. Cash plus something else. You can keep it simple with cash and SP500.

I’m already living a 1950’s life. Do not plan to change my lifestyle.

People may take on margin debt by pledging securities as collateral. They may use this money to buy or short sell securities. They may use a margin loan to pay off a subprime mortgage. People may go on margin to write puts or calls.

Taking up some debt at fixed rate through some mortgage is not that stupid if you expect inflation.

Just make sure you have enough even if housing and stock will go down more than 2/3

Businessmen who took on a lot of debt at the beginning of the Weimar Republic hyperinflation became very wealthy.

They were eventually able to pay the debt back for essentially at a 90% discount

Yes, although here, I think the people will collectively be demanding a pound of flesh before inflation gets to that point, and the elites will be forced to reverse.

Yep, and a lot of those vulchers who milked the system and took advantage of the chaos wound up in you know where if they we’re smart enough to get out of dodge while the gettin was good.

The internets just cracked the $500k mark on what they say my house…err “investment” is worth. That makes me half-a-millionaire. And to think not long ago my neighbors made comment our homes had finally hit the $350k mark.

The apartment I bought in central Stockholm, Sweden in the summer of 1993 is up 1000% (yes, a thousand percent)!

How much has a Volvo P-1800 gone up?

Can The Saint still get parts for his P-1800?

So why are you bragging? You are still a poor person according to standards of Toronto and Vancouver. Average price in Toronto 1.1 million last month. 3% increase over one month and accelerating. ? ? ✋

That was sarcasm. I don’t want to sound offensive to people that are not following real estate in Canada.

And the amazing part is that in Toronto, the economic hub of Canada, a software engineer earns less than a software engineer is some little town in US. Canada’s real estate market is based on drug dealers laundering their money in Canada and Canadian gov is kissing drug dealers … to encourage them to bring their dirty money to Canada.

Doesn’t phase me one bit. Toronto is small change compared Boston real estate, near where I live. :-). I moved out pre pandemic and bought cheaper better housing in Boston burbs.

And soon that 250k tax free capital gains you grt on primary house is not gonna be enough.

And Biden wants to increase cap gains to 40%, if you are unlucky, add another 16% for proposed cal state tax and whatever wealth tax Warren is talking about.

And yes, when you sell your house, your AGI will put you nicely in the 1%ers bracked

Us little people care nothing about capital gains.

In ’18, the top 1% of households got 69% of realized long-term capital gains and the top 20% received 90% of the gains.

The wealthy and the corporations have not been paying their fair share for a LONG time. We can’t afford to let them walk all over everybody else anymore.

Top 1% changes every year. As Moosy said, if you sell the house, if you get inheritance, if you win a lottery, you can end up being top 1% for that solitary year.

Translate ‘fair share’ to a number please.

Here cometh local Mr. Taxman. He likes how you invest.

“That’s also a feature of leverage: The first-out-the-door pocket the gains and get away unscathed. Late movers get crushed.”

Maybe, maybe not. Given the Fed has backed the markets it’s perfectly reasonable to take on a 20 fold leverage for stock positions. But if war were to come calling (Russia, China?), then we might see (God for bid! A few days down.) Will it be long enough to trigger margin calls or will the Fed (ala Japan), begin buying stocks?

I can smell the exuberance out there, the guys and gals glued to their computers hoping for just another up week so they can score big. I know this because I was one of them during the dot com craze. Spring ( which is a season largely lost on Californians), is a particularly potent driver of stock market optimism.

Vix is still too high, so it tells me more upside to come.

I’ve said it before, and I’ll say it again. The Fed has NOT backed the markets beyond jawboning. The jawboning was very effective, but all that means is that it’s one giant confidence game. The Fed doesn’t have to actually change any policies for it to collapse. They just need to have people lose confidence that they can fix all problems.

Odds are you will get wiped out completely even if you use 2:1 leverage over your investing life in the stock market. I believe even if you have the nerve to go 100% in stocks you end up with more money at 90% Stocks/10% cash due to the affect of putting money in on a pullback.

“Archegos Capital Management” …. well, they did a helluva job of managing now didn’t they ? With management like this, who needs chaos !!!

This is why I never took management classes in college…because all these years I’ve just managed fine !

People keep feeding the market record inflows at outrageous valuations this won’t end until Wall Street sucks up all the money then bend over if you get the idea same cycle different day

For every share bought a share is sold. Who is doing the buying and who is doing the selling? In a rising market, buyers are buying higher and sellers are selling higher. Something to think about.

For everything bought and sold, who is getting money?

Capital gains taxes and other taxes.

The house never looses. Government never looses. You loose

I’d rather pay capital gains taxes than take a loss. Taxes are a secondary expedient. Sitting on a loss is damaging to one’s psyche.

Uncle Salty. Sitting on a loss is tough for you and me but remember the PE firms and hedge funds playing with other people money dont care as long as they get there fees. They get their fees even if the market is going down.

Sellers are being seriously disincentivized. Buyers want lower prices. Nobody owns this market, except the Fed. Sellers want higher prices, and the Fed is giving it to them, what do they do with the cash? There is no price high enough for sellers to disinvest from the markets. Money velocity is stuck, while stocks go higher. Maybe they aren’t measuring that right? Stock prices do not represent economic activity, even if you can borrow against margined gains to start a business or take a trip. My broker assures me my PLOC will never be marked to market.

When foolish retailer is left holding the bag at the top, they take comfort in knowing that at least they own stock.

Ah, but do they? Do they really own the stock?

They look into that bag of stink they bought on the way up and find it empty, and much to their surprise, they wonder where their stock went.

Well, unless you bought the stock certificates, which are quite expensive, your shares are held in “street name” by your broker. That means your shares are available for shorting. So if you don’t want someone shorting your stock, you must buy the stock certificates.

Yes, either your broker will short the stock and bet against you, or lend the stock to another client for shorting. And your broker, NO, NOT YOU, but your broker, receives interest while your stock has been borrowed.

Ain’t that a peach? Your broker receives interest on merchandise you bought!

So now you find yourself hoping the market will come back and at least get you out at break-even. But in the meantime, somebody else has borrowed your stock, without you even knowing, and shorted it. In the meantime, you’re sitting on a paper loss.

Yes, if you decide to cut your loss and sell, you can sell immediately even though your shares may have been lent out.

Jesse Livermore said that when he found himself hoping, he just sold.

It’s widely reported Pelosi’s husband is buying stocks from info she’s privy to that the rest of us would go to jail for if we did the same. And a while back that woked “ethics” chick she appointed had a stock portfolio a mile long. Doubtless in my mind this is widespread in both parties. Jerome will keep doing just what he’s been doing. He’d be lynched tarred and feathered if he doesn’t.

My rant is not about being pro or against Trump.

Just 1-2 month before the election, when the market was down, I remember all the traders who were totally pro-Trump had started swearing at Trump and that he had let them down, etc. They had become totally disillusioned with Trump.

Comes in Pelosi; she started almost daily news conferences about resolving stimulus issues with Trump, and that Stimulus bill will soon be approved; the market turned around almost instantly because Pelosi was now helping Turmp to pump up the markets. That turned all the comments and all the traders who had turned against Trump back into the Trump camp.

My point is that Pelosi was trying to protect her own personal stock portfolio. This corrupted witch almost cost democrats the election just for personal gains. Imagine how corrupt you have to be to betraying your own party in such manner. I expected democrats to take away her post as the speaker of the house; but crickets. All these politicians sell their sole for money.

Small deli in New Jersey.

Sales of only $36,000 in the past two years.

No profit — not even close.

No one in their right mind would want a franchise unless they wanted to lose money.

No attempt to hide the financials.

The deli went public.

Valued at $101 million COB Friday 4/16/21

Can anyone top that?

What financial bubble?

The unbelievable story is here, with a picture of the unimpressive store:

Sounds like a bunch of baloney!

Yes, sounds like it, but it’s a publicly traded stock, and you can check it out at the SEC.

You should check it out before calling it baloney. If it was some hidden event that you could not easily researched it, then your mistake would have been explainable. But this is an event that most people are aware of; so, there is no excuse for not doing 2 minutes of research before calling it baloney.

lol. baloney. as in deli meat. it’s a joke see?

bungee,

If it was intentional, it’s hilarious — and totally went over my head. Great catch!

What’s interesting about that story is not the stocks valuation, since it is so thin that it can be easily manipulated , but that some people are so incredibly stupid to buy the stock in the offering last year.And that there are hundreds of stocks with higher valuations that never will be profitable .

Is that different than the market as a whole? People don’t actually think what they’re buying is a good value, but they’re convinced they can sell to a greater fool.

You cut off the link I provided, making this true story hard to believe.

That was unjustified censorship.

I will avoid commenting here in the future.

The stock symbol is HWIN.

I edited a for profit finance and economics newsletter from 1977 to 2020, and do not get fooled often. I was not fooled this time.

Just look up HWIN:

Richard Greene,

I generally don’t allow links, especially not click-bait links. I make some exception when commenters need to document something. Commenting guidelines #2: “This comment section is not a link dump…”

https://wolfstreet.com/2017/10/07/finally-my-guidelines-for-commenting/

So in your comment, just mention the name of the company and ticker symbol, and people can Google it and they can go to the SEC and pull up all filings. And they can check the news coverage. But you didn’t do that in your prior comment.

You now mentioned the ticker, and that’ll do the job. People can now look up the company and the stock price and the SEC filings and other stuff. This is what you should have done in the prior comment, rather than this mystery with a click-bait link.

I thought the “baloney” response to my comment was about the honesty of my comment, which lacked a stock symbol because the link for additional details had been deleted.

Thank you for a long and thorough explanation. But reading posting rules before making a comment seems … so un-American !

i don’t know what a “click bait link” means. I provided a link to the full story and a photo of the deli on my own free website (with no ads and no requests for donations, so there was absolutely nothing for me to gain personally by people clicking on the link for more information)

I could not figure out how to post a photo of the one deli of HWIN, and without any link you could not find that important photo.

Without that photo, or a link to it,

I would not have believed the story myself, if someone else had posted it

Gold bounced off big red Mar 9 2020 Engulf and June 1/ 8 Harami,

blocked by Nov 23/ 30 Harami.

Dear Readers,

Just to update everyone on the rogue ads you were seeing, but no longer see, and on the gangsters and slimeballs in the internet ad business from Google on down….

On April 7, rectangular banners started appearing on top of the text, covering up the text, and as you scrolled down, they moved with you (“sticky ads”). They disappeared, and then reappeared. These were rogue ads that I didn’t authorize, and would have never authorized.

I went around my ad agencies to determine who was responsible for them. They all denied having anything to do with them.

A few days ago, I narrowed it down which ad agency is likely responsible, and I asked them to take it off. They said they would check with their “tech team.” I gave them till last night to resolve this.

But I didn’t hear back from them. So this morning, I removed their ad code, so none of their ads are now running on my site. And miraculously, these rogue popups have stopped.

I don’t know where I will go with this ad agency. It depends on how they will try to resolve the situation.

Here is what the internet ad industry has accomplished many years ago: it has succeeded in taking control over ads away from publishers. The only control a publisher has is to either run the code or remove the code.

Once the code is installed, the publisher no longer controls what runs where – hence these unapproved popups. But removing the code means ad revenues from that ad agency go to zero.

I have for years shared my disgust with the internet ad industry, the layers of slimy gangster middlemen, called “ad tech” these days, that have inserted themselves between the advertiser (such as Ford) and the publisher (such as me).

And that is why I appreciate it so much more when a reader who owns a business wants to make a deal with me to advertise directly on my site to support my site.

One of my long-time readers and occasional commenter, Todd Miller, is advertising on my site. He owns factories that manufacture (in the US!) metal shingles. His video (with Todd in it) is posted above the comments. It’s a tour through his factory and an explanation of how the metal shingles are made. If you’re thinking about a new roof for your home or apartment building, or are a builder and want to look at roofing options, check him out. And Todd, thank you for supporting my site.

I saw that video a few days ago and decided to watch it. I found it fascinating. It’s always interesting to find how things are made. Putting faces on products is also something that I like as it gives an additional connection when I buy or use something.

I have had metal shingles for about 5 years, and I highly recommend them. I am in Colorado and I have had as much as 2 feet of snow on them, plus a couple good hail storms, with no damage.

Hi Marbles. For comparison what is the difference in cost and difference in expected life do the metal shingles have over good quality asphalt shingles? I would expect 2’ of snow staying on a roof where I’m may be about a 1 in 50 year event, but interested in the wear and maintenance. Thx!

Hi Shiloh1. Metal shingle roofing is a great option for harsh weather areas as well as mild weather. It is designed for homeowners who want the durability and other benefits of metal roofing, including energy efficiency, but they want a more traditional look than the vertical seam metal roofs you usually see on commercial and agricultural structures. The typical metal roof customer intends to remain in their home for 10+ years so they realize the benefits of their investment. The initial investment is often 2 – 3 times the cost of asphalt shingles though that may change as asphalt shingles are currently short in supply and increasing in price regularly. One thing to keep in mind though is that for many years the driving factor in roofing costs has been the skilled labor to install the roofing. We do not expect that to change. So, long term roofs such as metal make sense by avoiding future repair and replacement costs. Quality metal roofs are also great for “family legacy” homes as they will last 50+ years and can be repainted at the end of that period rather than replaced. Helpful websites for education and ideas are

http://www.asktoddmiller.com and http://www.classicroof.com

I have actually had this on for 7 years, time flies. I don’t recall the difference in cost, actually not sure it was much at all. I replaced cedar shakes that were almost 25 years old. This product came with a 50 year warranty, with some limitations, such as hail over 2″ in diameter. One of the reason I went with it is I have had metal roofs on all my buildings at my ranch, and hail was the major reason. Those are all metal sheet roofing, and will withstand hail, but dent easier than this one. I’ve had them for over 20 years with no problems.

In times of drought, who wants compressed asphaltic bottom of the refining cracking tower garbage mixed with sand, bleeding chemicals into their garden soil, streams and lakes?

Asphalt shingles are toxic waste for sale, rather than paying to dump the crap. Long live metal shingles!

In addition to these sleazy ad agencies, you have to wonder about the companies that buy ads like this from the agencies. I mean do they make a deal to pay extra for a sticky add that is almost sure to piss everyone off. I personally would never buy anything from one of these ads. Even if I was planning to buy something from a company and they ran an ad like this on a site I used I would change my mind and buy from someone else.

Seneca’s cliff,

Most of these ad agencies, such as the one I just disabled, buy their ads from ad exchanges, such as Google’s ad exchanges. This is done via bidding, automatically, in milliseconds.

Another ad agency I have makes deals directly with advertisers (TD Ameritrade and other financial firms whose ads you see quite a bit near the top of the page). I appreciate that. But they also fill in with ads they get from ad exchanges.

Wolf,

What amazed me years ago when I actually looked into the internet ad space was how many companies there were, literally you could trip over them in your sleep if you’re not careful.

The middle of the page ad was annoying, but nowhere near as annoying as the crap that you had everywhere else. Reloading usually took care of the problem.

Although I would note that those ads started when you began running amok with your WTF articles last week.

Three in a week. Wow.

Don’t complain to just the ad agency, complain to the companies too, then write a comment asking people not to buy from them. Post the companies’ phone numbers so others can complain too.

Petunia,

That’s funny… because the most persistent rogue ad I saw was from an outfit called Womply, that is trying to get people to use it to apply for PPP loans — and they ran on my article about all the PPP loan fraud ?

Speaking of PPP fraud, I would like to see Wolf post an article about all the fraudsters that defaulted the PPP program.

I would like to see NAMES! and AMOUNTS!

Evidently a pertinent ad to emphasize the PPP loan’s cause célèbre status! :)

By the way, Wolf, is it time to look at the Chinese trend of letting some of their own government departments run business’s go under?

The corporate debt doesn’t look very rosy in the land of , tigers.

It looks like we going to have massive problems in the Chinese stock markets ( this includes HK)!

in the coming months.

They are relying now on the sovereign fund management to take over the debts of various government departments!!!

It will get ugly there, something that doesn’t bode well for all those Chinese companies listed on the NYSE!!

Will there be a run on them too by the locally scared investors?

Every one can see how overvalued these turds are, it is the trigger time I guess.

It is a wild ride, from here on.

Enjoy ?

Wolf – Thank you for explaining what was going on with those pesky ads. I am happy to learn that you did not authorize them. I appreciate you acting to remove them. You are a class act.

+1. It has also stopped the automatic page reloads too, Wolf. Thank you for your prompt actions which have definitely improved page usability.

Very pleased to be able to help support your work, Wolf. You are always insightful, well-researched, and easy to understand. Thank you. All of your readers need to help spread the word about you!

Hey Wolf,

Having run an information-based website designed primairly to enlighten others, rather than profit myself, with hopefully some balance between these two points, I ran into another problem with the nature of the google codes themself, the codes which are necessary for both ad service and the related powerful statistical insights google code offers webmasters.

The frikken google ad/anaylitical codes are brutally intrusive to your (our) visitors, giving google yet another avenue of deep digital tracking of every visitor, adding even more focused, “profiles,” of every visitor’s interests and behavior through tracking their uses of every specialized website’s content, (mine-yours-everyone’s), through these google analytic & add-service codes, besides offering the webmaster analyitics and add service.

Google is using the code on our sites, and everyone’s sites, to refine their profiles of every IP they track (everyone’s) and maintain records of everything/everyone they can monetize, which is everything.

The Google codes act as spies on our visitors, on their basic privacy…

Then google sells this info to anyone with a buck, as well as, most likely, making it available to any/every govt agency wanting to look into anyone’s life for about anything. (See Snowden…)

I figure google is playing/leveraging their information access, via having their code on about every website in the world, to their greatest advantage in every respect possible, likely beyond even my speculations above…

For that reason I removed google analytics from my sites, to protect my users privacy in my little garden. But, that comes with serious ramifications and costs to anyone desiring what they offer: search ranking advantage & access to a revenue stream.

Better than my purist approach to privacy (digital suicide?) would be proper regulation of the internet giants in regards to privacy, (as well as the various aspects of general market-monopolization, individual and group censorship, and the various veins of propagandas/fake news manipulations our internet giants are practicing…Hear of Tonklin Gulf? Sounds so quaint in our, “digital,” nowadays…), but that’s as likely to happen as our politicians actually representing either our people or the Constitution (rather than their classic and digital bribers…), or as likely as the Pope converting to Judaism, so your solution to this aspect of, “out of control code,” to de-code the miscreants, is about as far as anyone who wants to make any money at all, with high quality information and matching ethics such as yours, can go.

Hell Wolf, your incisive, accurate observation-analysis cuts to the core of much of the (economic/political) bullshit powering the degradations of behavior we are seeing in every aspect of social life (esp including the web!), which also bleeds over to every aspect of life.

I will take some google tracking for that. For now…

And, I’ll take some bad ads just to watch you take on some new dragons! Or are those Windmills? (joke-ha-ha) Either way, your efforts revealing market distortions/manipulations should make more money than the manipulations, if we had a decent world…not holding breath…but thanks!!

I’m hoping my use of a VPN has them sniffing up the wrong IP tree.

Also transitioning to Brave brower and DuckDuckGo search engine.

May transition to ProtonMail in long run. But some Google services I’ll stick with as long as they are extremely useful.

For example, Google Maps, Calendar, and Google Voice with my free U. S. phone number which is great for expats living overseas. Google voice converts audio phone messages to text and emails them to me. Extremely convenient if one has no U.S. residence.

I prefer to use Qwant as a search engine, it’s French and it doesn’t seem to censor US current events and news quite as much as the US based tech sites.

During a recent riot in the US, anybody who searched for news about riots on Google had the riots in Ireland at the top of the results. I expect that something similar may happen when the verdict in the Chauvin trial is delivered – everybody and their brother is expecting a lot of “mostly peaceful but occasionally fiery” ‘protests’ in the US when the verdict is announced. During the LA riots back in ’95 I noticed that strange things happening around me were not reported in the local media, such as a large clouds of smoke that appeared and were dismissed as “railway embankment fires”. The smoke could be seen from miles away. Hmmmm. I drove around that cloud just to be safe.

Believe the evidence of your own eyes and ears, and stay safe this week.

I removed the Facebook like button code, and the Twitter and other sharing codes years ago for that reason. FB is absolutely the worst about tracking because it knows so many people in true name, which Google doesn’t.

True name? That’s what they think. :-)

VPN, Firefox, AdBlockers, What ads?, except the cool shingle guy, changing location on the VPN every time you log out. They don’t have jack on me.

Yes, we have two mugs and may build a place setting of them. There’s a street address somewhere here to send checks to as well.

I use the Brave browser and have ad blocking enabled precisely because I hate ads that take over my computer, as you described above. Autoplaying ads that have the volume turned up to maximum are a particular pet peeve of mine. I live in an apartment and I don’t want to blast my sleeping neighbors wide awake when I use the Internet after midnight.

I can see the ads for the metal shingles, despite the ad blocking done by the browser I am using. This is unusual, BTW, Brave blocks 99% of ads.

Silver was up this week. My time frame is short. When Silver reached

Aug 10/17 Harami and Aug 31/ Sept 8 Harami I clicked, because the risk was high. Silver might osc between big red Sept open and close.

Feb 24/ Mar 2 is support.

Do us a favor, and do your free advertising on Twitter.

Do you recommend a monster box of maple leafs or 1000 oz bars?

Those 1,000 once bars are incredibly dangerous if they accidently pinch your fingers! Don’t ask me how I know!

I like the monster silver boxes of ASE’s. I have a fear that some day I’ll want to buy gas and I’ll be standing at the pump trying to shave a piece off a 10 oz gold bar.

Silver will probably work for small/medium purchases. A 10 oz gold bar is what you give the freighter captain to get you to another country.

I gave every member of my family 20 ASE’s just in case.

If you keep a 500 coin monster box at home and it gets stolen, just keep an eye out for guy with a ruptured disk or hernia.

I also like the 1,000 round cases of hollow points.

In my view, there are dozens of Archegos type family office/hedge funds which are trading at huge multiples like 1:50. At that leverage, If such entities have only $20 billion, they can trade as if they are $1 trillion entities . Even at 20:1 leverage such entities can trade as if they are $400 billion entities.

Silver daily was blocked on the Feb 2/ 3 Harmi.

WTF is Harmi?

Is there an online dictionary where we can learn your shorthand, acronyms and code? Whatever you have to say looks interesting, but the gobbledygook…

1) Silver daily line chart : Mar 8 and Apr 12 look like an inverse H&S, with a head on Mar 30.

2) It might fail for the following reasons :

3) dma50 on top of Fri close.

4) Efforts/ results : Mar 18 price is higher than Fri close, but Fri RSI

is higher. That’s bearish.

5) Silver is still in bearish territory after bouncing off Mar 30 close.

6) There is no NR in bearish territory.

7) Feb 2/3 Harami.

Micheal Engel – I want to understand the content of your posts. I truly do. But I can’t, despite spending 35 years in finance. Please help me to learn from your posts, as I do from so many others on this forum. You have something to say, and I want to benefit from it. Please express your thoughts in a way that a reasonably experienced business person can follow. Thank you. With all sincerity and with due respect. – Thomas

Doubting Thomas,

Don’t try to understand Mr. Engel’s post. I too, have tried and failed.

But you can still enjoy reading his posts. Sometimes you might catch a golden nugget.

For example, here’s one from a while back concerning Tesla, don’t remember the exact wording but totally made me laugh:

“Tesla reported retained earnings of minus 3 billion dollars.”

Now, if Mr. Engle made that up, that’s just freak’n brilliant. What a great way to put a spin on a loss!

I just ignore them. While I think he actually has some good insight, he refuses to write in a way that makes any sense.

To me it all sounds like numerology or Tarot card readings.

You can Google Harami- he isn’t making it up. Harami’s are candle indicators that can appear at the top of an uptrend, or at the bottom of a downtrend- bearish in the former and bullish in the latter- they often denote sudden doubt in both trends.

Are you looking just at silver or the market based on silver? And does this type of analysis work well for you?

8) April Wantabe trending up.

9) Sumtingwong may peak in May-June.

As I was reading Wolfe’s article, I just couldn’t stop thinking of the parallels

with Acme Inc and Wile E Coyote.

Acme keeps selling Wile leverage products that keep back-firing or blowing him to smithereens!

Wile never seems to learn that Acme’s products always work perfectly, no matter how carefully or carelessly they were used!!

American financial engineering at it’s finest! Still batting 100%!

I don’t know….when multiple trillion $ increases in government budgets and spending are being thrown around, its kind of hard to get too incited about Margin Debt going up by a couple of hundred billion. There are just too many scams and fraudsters to keep track of these days.

S&P 500 is north of 4000, so the margin debt looks about right to me.

You’re begging the question.

My 85 yr old Dad (Trump supporter, life long Republican) just said it’s time to get rid of masks. Jerome is on record stocks are up because vaccines. Ok then, so why do we need QE & ZIRP if vaccines are doing the same thing? Why doesn’t Jerome go to the opening Bell on Wall Street, theatrically rip his mask off, and kick off his gambling casino for the day? Then terminate QE and raise the discount to 3%. They could broadcast it all famously free TV news.

Because Jerome likes being able to wake up alive each day.

They started QE in response to the overnight interbank liquidity markets spiking to 8% in Sept 2018.

How close are we to a major correction? Some say fall, some say next year, I keep thinking any day.

It’s impossible to say. Just watching the action in the crypto market today makes it look like it could all come crumbling down right now.

Hernando, things are so fragile right now pretty much anything could pop the everything bubble.

The mirrors have cracked and the smoke is dissipating, I don’t think it can last ’til fall.

What a heck of a show!

“Some say fall, some say next year, I keep thinking any day.”

Since these predictions seem to be all over the map in terms of time frame, I’d have to predict that nobody really knows.

Back in 2009, I was predicting the March bottom of 666 in the SP500 to be taken out later that year. Boy was I wrong…

Are hedge funds and other big players responsible for the majority of this leverage? If so, can we really expect the market to crash and for them to get cleaned out wholesale? These are the people that run the show, and I highly doubt that a system like ours would allow these people to lose their shirt. It feels like they know something we don’t, or maybe they know if the market does crash they will continue to get bailed out by our government? If that’s the case, I’m just wondering what the end game is, and I’m skeptical it will end well for those of us who are being prudent and trying to stay away from this bubble. Feels like all most of us are going to get out of this is massive inflation unless things are allowed to run their course and we stop bailing out the super wealthy.

I don’t believe the FED can hold this whole thing together. It’s absolutely ridiculous. And when it all falls apart I think I’m going to have my pick over used cars, trucks, etc. – and real estate at some point. The excesses I see everywhere are nothing short of outrageous, and it’s all leverage and debt.

I keep reminding myself that in 2010 I bought a 3 year old 2,000 sq. ft. brick ranch in a great neighborhood in Texas for $64.00/sq.ft. My daughter and her husband live in it now. The same size house next door just sold for $150 per square foot, full price offer.

At that time, if I had the cash, I could have bought a dozen of them. I remember bidding on the bank repos and the HUD foreclosures. I couldn’t hit on any of those as the “big guys” were reeling them in like fishing with a big net.

We will see that again, and I have the cash now to buy another.

As much as I do wish you’re right I have my doubts, this FED seems to be unlike anything we have seen in history. Sure one day it will blow up in their face but it’s all about duration. Even if you and I are right, will I be alive long enough to see our prediction comes to fruition? Being right in wrong timing might as well be wrong..

It’s all going to fall apart. Just look at this crypto scam. Bitcoin just went from $62,000 to $51,000 today. Imagine how many people that just wiped out. And imagine if everybody runs for the exits.

I think a lot of Bitcoin is held forever as ‘play money’ for rich folks. I am not sure everyone will run for the egress.

Now if the gov’ts around the world decide they don’t like crypto, then that is a different story.

I think what’s change is that so much retail investing is now small dollar fractional ownership. If I bought $100 of BTC, I don’t really care that it went down to $80, nor do I care if it goes to $200. Same with TSLA or ARKK.

Now if I had invested $200K and it doubled?

Yeah? I too am about ready for a used-year-old Camry and some lumber.

Wolf,

Why not do a chart of margin debt as a percent of total market cap? That would be a much better perspective, as nominal debt is virtually meaningless over a 40 year time horizon due to the run up in equity prices.

Margin debt as a percent of market cap is meaningless because market cap depends on margin debt because margin debt drives up market cap, and drives it down. That’s what leverage does. That’s the point of the article.

Which makes me wonder, as a layman:

Under what circumstances is an increase in market cap related to an increase in real productivity?

If we had a market where stock buybacks were illegal, and the value of money was stable (no inflation or deflation), then the only sure way to improve the value of the stock of a company would be to actually earn more money by selling more products. Mergers and takeovers would tend to have a neutral effect on the stock price of the bigger company, as most of them don’t immediately generate higher profits for the buyer.

Productivity and stock prices would then be closely linked in reality, instead of only in theories found in dusty old editions of economics textbooks from the 1950s.

Hussman posted a market comment a week ago (on his website hussmanfunds) in which he shows a chart of margin debt to GDP.

WTF? Wait till we reach WTF Squared.

The world is three dimensional. Try cubed.

You know, you could easily imagine people buying options in anticipation of the inevitable collapse, but I believe the old saying goes, the market can stay irrational than a person can stay solvent.

You just know there is Michael Burry type out there sitting on a load of shorts, and he is going to be famous enough for books and movies.

Yeah, is name is Michael Burry lol

Michael Burry must has some inside info from climatologists that a massive drought is coming in California. He is investing in water rights. I wonder how you do that? What was the name of that movie with Jack NIcholson about a fight in California about water rights? People were killing each other over it.

Swamp Creature,

No special insights required. California is short on water, particularly agriculture, which uses something like 85% of the water in California. And the water-rights system is a huge mess. So surely, people would want to make money of this situation at the expense of everyone that has to use that water.

We got our own water problem here, already. Once a month the water turns brown because of a water main break somewhere nearby. The local Water company WSSC says its safe to drink. Who the hell would drink brown water? Even when it is clear It tastes like mineral water. The infrastructure dates back to the 1930s. Where is our tax money going? We drink only bottled water. I have a 30 day supply. I may make it 60 days.

There are lots of people investing in water rights, T.B.Pickens before he died bought up a bunch of it in TX.

It is really the most undervalued commodity right now.

I wonder if there is an organization out there collecting water right today. May be it is named Quantum.

I’m collecting my water rights. Stocking up on a 60+ day supply of bottled water.

Chinatown. 1974.

Yep, that was the movie about a fight over water in California.

Fight was a land grab. Water was used as the pry bar to get people off their land. It was set in the thities but based upon historical events from much earlier. In the sequel, The Two Jakes, it was the mineral rights and the oil under the land versus housing tract development. And a little sex, ’cause Hollywuud requires that…ref. Sullivan’s Travels for that.

The case for an extended period of low rainfall such as we had this year, is climate change. The Pacific Ocean is heating more rapidly, (because it is larger) disproportionately placing the effects on the western hemisphere. The heat pushes the jet stream higher. We are getting weather today (hot dry and windy) we never see this time of year. Fortunately water consumers have already adjusted. Almost no one has a lawn, and everyone has restricted flow devices. You can’t give a lawn mower away. They drilled sump holes in the bottom of Lake Mead, but Vegas is dying anyway. Mexico is probably going to challenge the US for their fair share of the Colorado River. Maybe they will get reparations for Texas as well? Since Mexico grows a great deal of US produce they should give it to them. The central valley water table has collapsed. Ca agricultural gets a low rate and first dibs on the water supply, they resell it to various munis, so water could get cheaper if farmers cut back. The state depends on the Sierra snowpack which is usually better than rainfall totals. The expansion of fire zones, and seasons is probably the bigger problem.

The movie you are thinking of is Chinatown.

I’m amazed watching things get more and more irrational. Many big market mechanisms have got to be near the breaking point. I keep wondering what will go first. Will low wages vs high cost of living finally kill demand and shut down the unbacked credit lines to broke masses? Will that in turn kill 3k mile supply chains that are only cost efficient as long as there is a wage/credit differential between the selling country and buying country? Will UBI be instituted to keep it all going a bit longer until the currency burns up in an inflationary bonfire? Will the stock markets break and take down all the Archegos out there along with their counter parties which will make loads of ‘wealth’ in stocks, and many other investment vehicles disappear? That would seem to be deflationary since it drives a great deal of the credit creation that fuels inflation.

I feel like this blog could be called Wolf’s WTF Street until these fantasy markets crash into reality again.

The WTF’s will be repeated a thousand times from all those millions of ‘investors’ currently in the market, when these stocks all collapse by 90%.

I thought all the same thought but starting 3 years ago. It seems as if the FED has an deep hat that they can keep pulling more rabbits out of.

Who is to say this cannot continue for a few more years. What is out there flashing breaking points.

I got out of the markets in 2007 as I could see the housing bubble would pop. There were too many houses and a bunch of subprime mortgages that could not be paid when the teasers rates ended.

Yes, housing is overbought, but there are some fundamental reasons. Not enough houses. Housing prices can drop when forbearance is over but will we have jingle mail. Probably not as we do not have subprime borrowers. Most people owning homes are in good shape, their mortgage payments, because of low interest rates, are affordable.

Just trying to look for sighs.

There is a lot of money to be made on levering up. I remember when people around me started buying houses and essentially became lottery winners on the appreciation starting around 2003. I was never willing to fully play that game. The ups were intense but the downs could wipe a person out. I was only willing to play as an all cash buyer and lost out to all the folks willing to borrow up to their eyeballs who could outbid me and who could then ride the gain rocket to the moon. Several of them blew up in 2007-08 but the ones that didn’t are pretty wealthy now. I played the conservative game. No wealth rocket or early retirement for me but no debt either. Gov’t and Fed policy have made fools out of folks like me that were trying to work hard, be responsible and not take stupid risks.

I enjoy these articles and the comments. I always expect to take away at least one pearl of wisdom. For this article it is Augustos comment:

“There are just too many scams and fraudsters to keep track of these days.”

This is what Central Banks have been doing for eons. Driving up the amount of loans (pumping up the currency supply) and when they find the time is right, they call in the loans (contracting the currency supply), causing a crash. They and their cronies will be positioned to do well.

But we can anticipate. Only timing is very difficult.

I think the next crash will happen when CBDC’s (Central Bank Digital Currencies) are ready to be deployed. They will not tell you when that moment is. But after the fact they will tell you that CBDC’s will be the answer to the crisis. And the next Ponzi/Pyramid game will be born. “And you will be happy” – (Claus Schwabb).

1) USD lost 98% of it’s value, because of Nixon.

2) Side by side comparisons, EURUSD is stable between 1.00 and 1.25.

3) The pair USDJPY is stable at around 100, despite perpetual devaluations.

4) Nixon inherited saint LBJ smoke screen.

5) Charts don’t lie. They tell u where the minefields are. Read the charts. Takeoffs are optional, landings are mandatory.

6) People lie. They tend to cluster together with people like them, with

the same political views, same hobbies, same drinks and the same lies.

7) No harm is done, because they don’t know what they never knew.

8) The economy is strong. The new gov stimulus induced inflation and US economy will fly for at least two more years.

9) Gov can pile up debt, but companies can’t. When the debt portion is too high relative to total assets companies go bk. Private companies

cannot compete with gov perpetual debt, for buyback, executives perks, stock options, dividends and high TSR pinoccios.

10) Immanuel Kant : if everybody lie, language stop to have meaning and communication would become impossible ==> thereby making

lies impossible as well.

11)

Economy is strong, LOL. Thanks for that laugh.

Their was a line of people at the food counter at Burger King this morning. Some were really old folks…older than me! I guess the economy is on fire.

In the context of his post, he is not wrong. ?

“8) The economy is strong. The new gov stimulus induced inflation and US economy will fly for at least two more years.”

You left off the sarcasm tag /s, didn’t you?

In what parallel universe is a US economy ‘strong’?

Haven’t you heard? A strong economy requires $4 trillion deficits, trillions in QE, and ZIRP these days.

Current P/E ratios are insanely inflated. Very few companies are making any profit by normal means. They are pumping the stock price by buying back shares. 62% of American households don’t have $400 cash. Claims that the economy is strong make me wonder if you type with one hand while smoking crack with the other.

More than 62% of Americans had more than $2000 – briefly. My old friend that can’t seem to hang on to a $200-$300 cash emergency fund spent the first $600 on new classy sheets and bedding. So it goes…

But was it a business investment?

@ Lynn: Well, the last name of Lisa is “Hooker”, so maybe for her ‘old friend’ it was a business investment ;)

The markets for many things are beginning to “lock up”.

People who want to sell their house , cant, because there is nowhere for them to move. The Fed is loaning (buying MBSs) at below real inflation rates….

Contractors can’t bid jobs because the material prices are so wild they cant lock in a price..IF they can even get their hands on the materials.

Does Jay Powell know this? Does he care?

About 2011-2012 a Florida condo sold for $50,000 as bank owned property was dumped on the market. Arkansas is cheap, but the high paying jobs are elsewhere. Some retirees own one or two vacation homes. The Bidens own several properties and can stay in DC rent free. When companies reported EPS growth, investors became interested. A lady recommended I should buy Facebook when it IPO’d. I did not even know what Facebook was at the time and ignored the advice. Mea culpa.

historicus

“The markets for many things are beginning to “lock up”.”